UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

HOSTESS BRANDS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 28, 2017

Dear Fellow Hostess Stockholders:

You are cordially invited to attend the 2017 Annual Meeting of Stockholders of Hostess Brands, Inc., which will be held at Loose Mansion, 101 E. Armour Boulevard, Kansas City, Missouri 64111, on Thursday, June 15, 2017, at 10:00 a.m. local time.

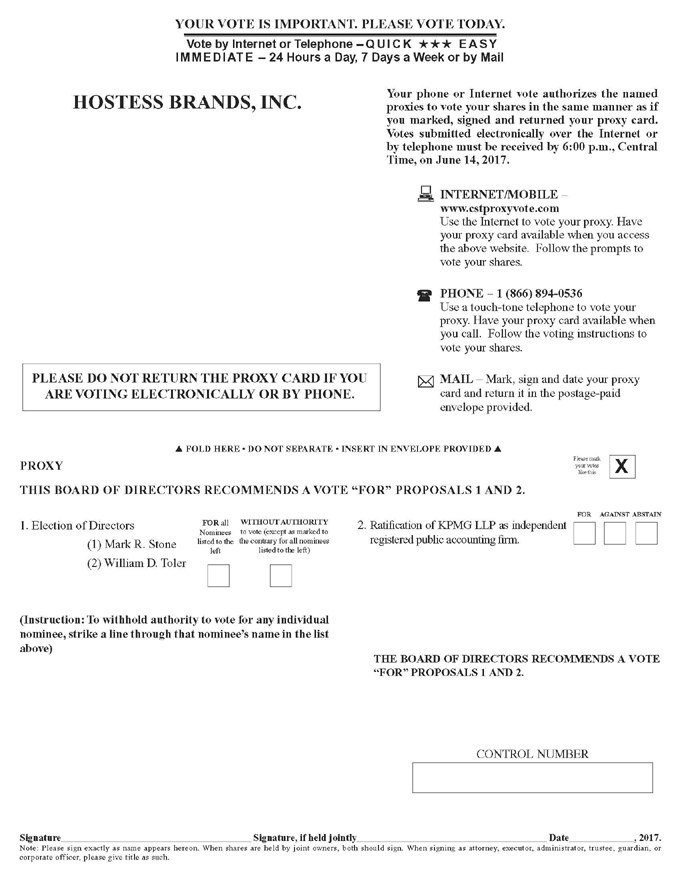

At the Annual Meeting, we will ask you to elect two members of our board of directors and ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017. Andrew Jhawar, a member of our board of directors, has decided not to stand for re-election at the Annual Meeting. In connection therewith, the board has nominated me to stand for election as a Class I director. Mark R. Stone, another member of our board of directors, will stand for re-election.

We have elected to provide access to the proxy materials over the internet, other than to those stockholders who requested a paper copy, under the Securities and Exchange Commission’s “notice and access” rules to reduce the environmental impact and cost of our Annual Meeting. However, if you would prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice of Internet Availability.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, we urge you to promptly vote and submit your proxy via the internet, by telephone, or by mail, in accordance with the instructions included in the Proxy Statement.

On behalf of the board of directors, we would like to thank you for your continued interest and investment in Hostess Brands, Inc.

Sincerely,

William D. Toler

President and Chief Executive Officer

HOSTESS BRANDS, INC.

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

| Time and Date: | Thursday, June 15, 2017 at 10:00 a.m. local time. | |||

| Place: | Loose Mansion, 101 E. Armour Boulevard, Kansas City, Missouri 64111 | |||

| Items of Business: | (1) | To elect two Class I directors to serve until the 2020 annual meeting of stockholders or until their successors are duly elected and qualified. | ||

| (2) | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017. | |||

| (3) | To consider such other business as may properly come before the meeting or any adjournment or postponement thereof. | |||

| Adjournments and Postponements: |

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. | |||

| Record Date: | Holders of record of our common stock as of the close of business on April 21, 2017 will be entitled to notice of, and to vote at, the Annual Meeting. | |||

| Voting: | Your vote is very important. All stockholders as of the record date are cordially invited to attend the Annual Meeting and vote in person. To assure your representation at the meeting, however, we urge you to vote by proxy as promptly as possible over the Internet or by phone as instructed in the Notice of Internet Availability of Proxy Materials or, if you receive paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card. You may vote in person at the meeting even if you have previously returned a proxy. | |||

By Order of the Board of Directors,

Jolyn J. Sebree

General Counsel and Secretary

This notice of Annual Meeting and proxy statement and form of proxy are being distributed and made available on or about April 28, 2017.

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on June 15, 2017.

This proxy statement and our 2016 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, are available at www.cstproxy.com/hostessbrands/2017 and at www.hostessbrands.com under the “Investors” tab.

|

| 1 | ||||

| 2 | ||||

| 7 | ||||

| 7 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 29 | ||||

| PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

31 | |||

| 33 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

34 | |||

| 37 | ||||

| 39 | ||||

| 40 |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the proxy statement before voting.

Annual Meeting of Stockholders

| Date: |

Thursday, June 15, 2017 | |

| Time: |

10:00 a.m., local time | |

| Location: |

Loose Mansion, 101 E. Armour Boulevard, Kansas City, Missouri 64111 | |

| Record Date: |

April 21, 2017 | |

| Voting: |

Stockholders as of the record date are entitled to vote. Each share of Class A common stock and Class B common stock, voting together as a single class, is entitled to one vote. |

Proposals and Voting Recommendations

| Board Recommendation |

Page | |||||||

| Election of Directors |

||||||||

| William D. Toler |

For | 16 | ||||||

| Mark R. Stone |

For | 16 | ||||||

| Ratification of our independent registered public accounting firm |

For | 32 | ||||||

Voting Methods

You can vote in one of four ways:

|

Visit www.cstproxyvote.com to vote VIA THE INTERNET | |

|

|

Call 1-866-894-0536 to vote BY TELEPHONE | |

|

|

Sign, date and return your proxy card in the prepaid enclosed envelope to vote BY MAIL | |

|

|

Attend the meeting to vote IN PERSON |

To reduce our administrative and postage costs and the environmental impact of the Annual Meeting, we encourage stockholders to vote via the Internet or by telephone, both of which are available 24 hours a day, seven days a week, until 6:00 p.m. Central Time on June 14, 2017. Stockholders may revoke their proxies at the times and in the manners described on page 4 of this proxy statement.

If your shares are held in “street name” through a bank, broker or other holder of record, you will receive voting instructions from the holder of record that you must follow in order for your shares to be voted. If you wish to vote in person at the meeting, you must obtain a legal proxy from the bank, broker or other holder of record that holds your shares.

1

HOSTESS BRANDS, INC.

1 E. Armour Boulevard

Kansas City, Missouri 64111

2017 ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement and the enclosed form of proxy are solicited on behalf of Hostess Brands, Inc., a Delaware corporation, by our board of directors for use at the 2017 Annual Meeting of Stockholders (referred to as the “Annual Meeting”) and any postponements or adjournments thereof. The Annual Meeting will be held at Loose Mansion, 101 E. Armour Boulevard, Kansas City, Missouri 64111, on Thursday, June 15, 2017, at 10:00 a.m. local time.

Internet Availability of Proxy Materials

In accordance with rules adopted by the Securities and Exchange Commission (referred to as the “SEC”) that allow companies to furnish their proxy materials over the Internet, we are mailing a Notice of Internet Availability of Proxy Materials instead of a paper copy of our proxy statement and our 2016 Annual Report to our stockholders. The Notice of Internet Availability of Proxy Materials contains instructions on how to access those documents and vote over the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how to request a paper copy of our proxy materials, including our proxy statement, our 2016 Annual Report, and a form of proxy card. We believe this process will allow us to provide our stockholders the information they need in a more timely manner, while reducing the environmental impact and lowering our costs of printing and delivering the proxy materials.

These proxy solicitation materials are being first released on or about April 28, 2017 to all stockholders entitled to vote at the meeting.

Record Date

Stockholders of record at the close of business on April 21, 2017, which we have set as the record date, are entitled to notice of and to vote at the meeting.

Number of Outstanding Shares

On the record date, there were 99,285,917 outstanding shares of our Class A common stock, par value $0.0001 per share and 31,104,987 outstanding shares of our Class B common stock, par value $0.0001 per share.

Requirements for a Quorum

The holders of a majority of the issued and outstanding shares of common stock entitled to vote at the meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Each stockholder voting at the meeting, either in person or by proxy, may cast one vote per share of common stock held on all matters to be voted on at the meeting. The Class A common stock and the Class B common stock will vote together as one class.

2

Votes Required for Each Proposal

Assuming that a quorum is present, directors shall be elected by a plurality of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Therefore, the two nominees who receive the greatest number of affirmative votes cast shall be elected as directors. We do not have cumulative voting rights for the election of directors.

The proposal to ratify KPMG LLP as the independent registered public accounting firm of our Company for the fiscal year ending December 31, 2017 shall be decided by the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote thereon.

The vote on each matter submitted to stockholders is tabulated separately. Continental Stock Transfer and Trust Company, or a representative thereof, will tabulate the votes.

Our Board’s Recommendation for Each Proposal

Our board of directors recommends that you vote your shares:

| • | “FOR” each of the two Class I director nominees; and |

| • | “FOR” the ratification of KPMG LLP as the independent registered public accounting firm of our Company for the fiscal year ending December 31, 2017. |

Voting Instructions

You may vote your shares by proxy by doing any one of the following: vote via the Internet at www.cstproxyvote.com; call 1-866-894-0536 to vote by telephone; or sign, date and return your proxy or voting instruction card in the prepaid enclosed envelope to vote by mail. When a proxy is properly executed and returned, the shares it represents will be voted at the meeting as directed.

If a proxy card is properly executed and returned and no voting specification is indicated, the shares will be voted (1) “for” the election of each of the two Class I nominees for director set forth in this proxy statement, (2) “for” the proposal to ratify the appointment of KPMG LLP, as the independent registered public accounting firm of our Company for the fiscal year ending December 31, 2017, and (3) as the persons specified in the proxy deem advisable in their discretion on such other matters as may come before the meeting. As of the date of this proxy statement, we have received no notice of any such other matters.

If you attend the Annual Meeting, you may vote in person even if you have previously voted via the Internet or by phone or returned a proxy or voting instruction card by mail, and your in-person vote will supersede any vote previously cast.

Broker Non-Votes and Abstentions

If you are a beneficial owner of shares held in “street name” and do not provide the broker, bank, or other nominee that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the broker, bank, or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is commonly referred to as a “broker non-vote.”

The election of directors (“Proposal 1”) is a matter considered non-routine under applicable rules. Therefore, a broker, bank, or other nominee cannot vote without your instructions on Proposal 1; as a result, there

3

may be broker non-votes on Proposal 1. For your vote to be counted in the above proposal, you will need to communicate your voting decisions to your broker, bank, or other nominee before the date of the meeting using the voting instruction form provided by your broker, bank, or other nominee.

The ratification of appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017 (“Proposal 2”) is a matter considered routine under applicable rules. A broker, bank, or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 2.

Each broker non-vote and abstention is counted for determining the presence of a quorum. The election of directors requires a plurality of votes cast. Neither broker non-votes nor any withhold votes in the election of directors will have any effect thereon. With respect to the proposal to ratify the appointment of KPMG LLP as the independent registered public accounting firm of our Company for the fiscal year ending December 31, 2017, because they represent shares present and entitled to vote that are not voted in favor of a proposal, abstentions have the same effect as votes “against” such proposal.

Revoking Proxies

Any stockholder giving a proxy may revoke the proxy at any time before its use by furnishing to us either a written notice of revocation or a duly executed proxy (via internet, telephone or mail) bearing a later date, or by attending the meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

Election Inspector

We have engaged Continental Stock Transfer and Trust Company to be the election inspector. Votes cast by proxy or in person at the meeting will be tabulated by such election inspector, who will determine whether a quorum is present. The election inspector will treat broker non-votes and abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, and as described in the “Broker Non-Votes and Abstentions” section of this proxy statement for purposes of determining the approval of any matter submitted to stockholders for a vote.

Voting Results

The final voting results from the Annual Meeting will be included in a Current Report on Form 8-K to be filed with the SEC within four business days of the Annual Meeting.

Costs of Solicitation of Proxies

We will bear the cost of this solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding solicitation materials to such beneficial owners. Proxies also may be solicited by certain of our directors and officers, personally or by telephone or e-mail, without additional compensation. We do not expect to engage or pay any compensation to a third-party proxy solicitor.

Householding

We have adopted a procedure called “householding,” which has been approved by the SEC. Under this procedure, certain stockholders of record who have the same address and last name, and who do not participate in electronic delivery of proxy materials, will receive only one copy of our Notice of Internet Availability of Proxy Materials, and as applicable, any additional proxy materials that are delivered. A separate proxy card for each stockholder of record will be included in the printed materials. This procedure reduces our printing costs, mailing

4

costs and fees. Upon written request, we will promptly deliver a separate copy of the Notice or, if applicable, the printed proxy materials to any stockholder at a shared address to which a single copy of any of those documents was delivered. To receive a separate copy of the Notice or Annual Report or, if applicable, the printed proxy materials, please notify us by sending a written request to our Secretary at 1 E. Armour Boulevard, Kansas City, Missouri 64111. Street name stockholders may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

Availability of our Filings with the SEC and Additional Information

Through our investor relations website, www.hostessbrands.com under the “Investors” tab, we make available free of charge all of our SEC filings, including our proxy statements, our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K, as well as Form 3, Form 4, and Form 5 reports of our directors, officers, and principal stockholders, together with amendments to these reports filed or furnished pursuant to Sections 13(a), 15(d), or 16 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We will also provide upon written request, without charge to each stockholder of record as of the record date, a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 as filed with the SEC on March 14, 2017. Any exhibits listed in the Form 10-K report also will be furnished upon request at the actual expense we incur in furnishing such exhibits. Any such requests should be directed to our Secretary at our executive offices set forth in this proxy statement.

This proxy statement and our 2016 Annual Report to Stockholders are also available at: http://www.cstproxy.com/hostessbrands/2017.

All of our SEC filings can also be accessed through the SEC’s website, http://www.sec.gov, or reviewed and copied at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549. Please call (800) 732-0330 for further information on the Public Reference Room.

The Class A common stock of the Company is listed on the Nasdaq Capital Market (“Nasdaq”), and reports and other information on the Company can be reviewed at the office of Nasdaq.

Information Deemed Not Filed

Our 2016 Annual Report to Stockholders, which was made available to stockholders with or preceding this proxy statement, contains financial and other information about our Company but is not incorporated into this proxy statement and is not to be considered a part of these proxy materials or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act. The information contained in the “Report of the Audit Committee” shall not be deemed “filed” with the SEC or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act.

Other Information

We were originally incorporated in Delaware on June 1, 2015 as Gores Holdings, Inc. (“Gores”), as a special purpose acquisition company (“SPAC”), formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or other similar business combination with one or more target businesses. On August 19, 2015, Gores consummated its initial public offering (the “IPO”), following which its shares began trading on Nasdaq. On November 4, 2016 (the “Closing Date”), in a transaction referred to as the “Business Combination,” Gores acquired a controlling interest in Hostess Holdings, L.P. (“Hostess Holdings”), an entity owned indirectly by C. Dean Metropoulos and certain equity funds managed by affiliates of Apollo Global Management, LLC (the “Apollo Funds”). Hostess Holdings had acquired the Hostess brand and certain strategic assets out of the bankruptcy liquidation proceedings of its prior owner (“Old Hostess”), free and clear of all past liabilities, in April 2013, and relaunched the Hostess brand later that year.

In connection with the closing of the Business Combination, Gores changed its name to “Hostess Brands, Inc.” and its trading symbols on Nasdaq from “GRSH,” and “GRSHW,” to “TWNK” and “TWNKW”.

5

Following the Business Combination, Mr. Metropoulos and the Apollo Funds continue as stockholders and Mr. Metropoulos became Executive Chairman of Hostess Brands, Inc. On April 19, 2017, the Apollo Funds, an entity controlled by Mr. Metropoulos and Sponsor (as defined below) completed a public offering of approximately 23.1 million shares of Class A common stock. In such offering, the Apollo Funds sold substantially all of the shares of Class A common stock owned thereby. As a result, Andrew Jhawar, a member of our board of directors and a Senior Partner and Head of the Consumer & Retail Industry team in the private equity business of Apollo Management, L.P., an affiliate of the Apollo Funds, decided not to stand for re-election to the board at the Annual Meeting.

As used in this proxy statement, unless the context otherwise requires, references to the “Company,” “we,” “us” and “our” refer to Hostess Brands, Inc. and, where appropriate, its subsidiaries. References to “Hostess” refer to Hostess Holdings L.P. and its subsidiaries, prior to the Business Combination and references to “Gores” refer to Gores Holdings, Inc., prior to the Business Combination. “Sponsor” refers to Gores Sponsor, LLC, a Delaware limited liability company and the principal stockholder of Gores Holdings, Inc. prior to the Business Combination, and the “The Gores Group” refers to The Gores Group LLC, an affiliate of our Sponsor. “Metropoulos Entities” refer to Mr. Metropoulos and entities controlled by him that continue to hold an equity stake in us. “Legacy Hostess Equityholders” refer to the Apollo Funds and the Metropoulos Entities, collectively.

6

Our business and affairs are overseen by our board of directors, which currently consists of seven members. Set forth below are the biographies of each of our current directors, except for Mr. Jhawar, who is not standing for re-election.

| C. Dean Metropoulos

Executive Chairman

Age: 70 Director since: 2016 Chairman since: 2016 |

Mr. Metropoulos has served as the Executive Chairman of the board since the Business Combination. Mr. Metropoulos is Chairman and Chief Executive Officer of Metropoulos & Co., a boutique acquisition and management firm focusing on the food and consumer sectors. From 2013 until the Business Combination, Mr. Metropoulos served as the Executive Chairman of certain subsidiaries of Hostess and member of the Hostess board. Mr. Metropoulos has over 30 years of experience in acquiring and restructuring businesses in the U.S., Mexico and Europe and has been involved in approximately 80 transactions, including investments in Pabst Brewing Company, Pinnacle Foods Group, Inc. (Swanson/Hungry-Man, Vlasic Pickles, Open Pit Barbeque Sauce, Duncan Hines, Log Cabin Syrup, Mrs. Butterworth’s Syrup, Aunt Jemima Frozen Breakfast, Mrs. Paul’s Seafood, Van De Kamp’s Seafood, Celeste Pizza, & Lender’s Bagels), Aurora Foods, Stella Foods, The Morningstar Group, International Home Foods (Chef Boyardee, Pam Cooking Spray, Gulden’s Mustard & Bumble Bee Tuna), Ghirardelli Chocolates, Mumm and Perrier Jouet Champagnes and Hillsdown Holdings, PLC (Premier International Foods, Burtons Biscuits and Christie Tyler Furniture), among others. Mr. Metropoulos holds a B.S. and an M.B.A. from Babson College. In light of Mr. Metropoulos’ business expertise, financial acumen and business industry contacts, we believe that he is well qualified to serve as a director on our board.

| |

| Mark R. Stone

Director

Age: 53 Director since: 2016

|

Mr. Stone has served as a director since the consummation of the Business Combination. Prior to the Business Combination, he served as our Chief Executive Officer since 2015. Mr. Stone is a Senior Managing Director of The Gores Group, a private equity firm. Mr. Stone is a member of the Investment Committee and a member of the Office of the Chairman of The Gores Group. Mr. Stone has worked at The Gores Group since 2005, in part, focusing on all Gores’ operational due diligence efforts and worldwide operations of all Gores’ portfolio companies. He has been a senior team member with key responsibility in several turnaround value-oriented investment opportunities, including Stock Building Supply (ticker: BMCH), a supplier of building materials and construction services to professional home builders and contractors in the U.S. Mr. Stone has served as Executive Chairman and/or CEO of several portfolio companies. Prior to joining The Gores Group in 2005, Mr. Stone spent nearly a decade as a Chief Executive transforming businesses across the services, industrial and technology sectors. Mr. Stone spent five years with The Boston Consulting Group as a member of their high technology and industrial goods practices and served in the firm’s Boston, London, Los Angeles and Seoul offices. Mr. Stone earned a B.S. in Finance with Computer Science and Mathematics concentrations from the University |

7

| of Maine and an M.B.A. in Finance from The Wharton School of the University of Pennsylvania. We believe that Mr. Stone’s significant investment and financial expertise make him well-qualified to serve as a director on our board.

| ||

| Laurence Bodner

Independent Director

Age: 54 Director since: 2016 Committees: Audit Compensation, Chair |

Mr. Bodner has served as a director since the consummation of the Business Combination. Since February 2017, Mr. Bodner is the Chief Financial Officer of Sovos Brands, a new food and beverage company seeking to acquire brands. Mr. Bodner served as a Senior Advisor at Advent International in its global retail, consumer and leisure team from March 2016 to February 2017. Mr. Bodner served as Executive Vice President, Chief Financial Officer and Treasurer of Big Heart Pet Brands (formerly Del Monte Foods) from 2011 through July 2015. He joined Del Monte Foods in 2003 and served the company for 12 years in increasing levels of responsibility across the Finance and Operations functions. Prior to Del Monte Foods, Mr. Bodner also held senior financial positions at Walt Disney Company as well as The Procter & Gamble Company. Since April 2015, Mr. Bodner has served on the board of directors of Hearthside Foods, a leading bakery, snack and customized solutions contract manufacturer for packaged food products in North America and Europe. Mr. Bodner received his MBA in Finance from Duke University and BA in Economics from Dickinson College. We believe that Mr. Bodner’s extensive experience in the retail and consumer industries will allow him to provide significant insight to our board and make him well-qualified to serve as a director on our board.

| |

| Neil P. DeFeo

Independent Director

Age: 71 Director since: 2016 Committees: Compensation Nominating and Governance, |

Mr. DeFeo has served as a member of our board of directors since the consummation of the Business Combination. Mr. DeFeo is an active corporate advisor and board member. Mr. DeFeo served as a Senior Advisor to CHARLESBANK Capital Partners from 2012 through March 2017. He retired in 2012 as Chairman and in 2011 as CEO of The Sun Products Company, a private $1.5 billion company he helped found in 2008. Prior to that he held Chairman/CEO positions with the NYSE-listed Playtex Products Corporation (2004 - 2007) and The Remington Products Corporation (1997 - 2003). Mr. DeFeo began his career with The Procter and Gamble Company, where he held various positions of increasing responsibility over a 25 year career, leaving as VP/Managing Director Worldwide Strategic Planning - Laundry and Cleaning. Following Procter and Gamble, Mr. DeFeo joined the Clorox Company, with direct responsibility for all of its U.S. business. Mr. DeFeo currently serves on the board of directors of Driscoll’s, a private agriculture company, where he chairs the compensation committee and serves on the company’s nominating and governance committee (since 1998). In addition, Mr. DeFeo serves on the board of directors of The Prostate Cancer Foundation, a not for profit corporation focused on funding research into the prevention and cure of prostate cancer. Over a 40+ year career Mr. DeFeo has served on over 25 boards, both public and private, business and non-profit. He has been involved with over 50 different businesses and brands. Mr. DeFeo holds a bachelor’s degree in Electrical Engineering from Manhattan College, where he also served for 15 years as a director. We believe |

8

| that Mr. DeFeo’s numerous public and private company directorship roles and his over 40 years of experience in the consumer products industry make him well-qualified to serve as a director on our board.

| ||

| Jerry D. Kaminski

Independent Director

Age: 60 Director since: 2016 Committees: Audit Compensation Nominating and Governance |

Mr. Kaminski has served as a member of our board of directors since the consummation of the Business Combination. Since January 2014, Mr. Kaminski has served as Executive Vice President and Chief Operating Officer of the Land O’Lakes, Inc. International business, leading commercial business ventures outside of the United States. The company currently exports products to over 50 countries and has established International as a primary growth platform. Mr. Kaminski oversees Land O’Lakes Global Dairy Ingredients, the Villa Crop Protection joint venture in South Africa, the Bidco Africa joint venture in Kenya and Global Seed Genetics in Mexico. Prior to his current role, Mr. Kaminski was the Executive Vice President and Group Executive of Global Dairy Foods from January 2012 to December 2013, where he led $5B P&L consisting of the entire Land O’Lakes dairy portfolio: Retail Dairy, Foodservice and Global Ingredients. From January 2010 to December 2011, Mr. Kaminski held the position of Executive Vice President and Chief Operating Officer of Industrial Foods, which consisted of the Land O’Lakes domestic dairy ingredients business. Mr. Kaminski was Vice President and General Manager of Dairy Solutions, where he ran Land O’Lakes’ domestic Foodservice business when he joined the company in March 2007 to January 2010. Before joining Land O’Lakes, Mr. Kaminski served as a Vice President and General Manager at General Mills, where he held various leadership positions in the retail and business-to-business segments. Mr. Kaminski also served as President and Chief Operating Officer at Sparboe Foods. In addition, Mr. Kaminski has been on the board of directors of the Global Dairy Platform since 2012, which is an association of the world’s largest dairy companies promoting sustainable dairy consumption. Mr. Kaminski holds a bachelor’s degree in Accounting and Finance from the University of Wisconsin and an MBA in Marketing from the Kellogg Graduate School of Management at Northwestern University. We believe that Mr. Kaminski’s international business experience, together with his background in the consumer packaged goods industry, is of value to our Board and make him well-qualified to serve as a director on our board.

| |

| Craig D. Steeneck

Independent Director

Age: 59 Director since: 2016 Committees: Audit, Chair

Nominating and Governance |

Mr. Steeneck has served as a member of our board of directors since the consummation of the Business Combination. Mr. Steeneck has been a member of the board of directors of Freshpet, Inc. since November 2014. Mr. Steeneck has served as the Executive Vice President and Chief Financial Officer of Pinnacle Foods Inc. since July 2007, where he oversees the company’s financial operations, treasury, tax, information technology, investor relations and corporate development. From June 2005 to July 2007, Mr. Steeneck served as Executive Vice President, Supply Chain Finance and IT of Pinnacle Foods, helping to redesign the supply chain to generate savings and improved financial performance. From April 2003 to June 2005, Mr. Steeneck served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Cendant Timeshare Resort Group (now |

9

| Wyndham Worldwide), playing key roles in wide-scale organization of internal processes and staff management. From March 2001 to April 2003, Mr. Steeneck served as Executive Vice President and Chief Financial Officer of Resorts Condominiums International (now Wyndham Worldwide). From October 1999 to February 2001, he was the Chief Financial Officer of International Home Foods Inc. Mr. Steeneck provides the board of directors with extensive management experience in the consumer packaged goods industry as well as accounting and financial expertise. We believe that Mr. Steeneck’s extensive management experience in the consumer packaged goods industry as well as accounting and financial expertise, make him well-qualified to serve as a director on our board.

|

| Name | Age | Class | Term Expiration |

Director Since |

Primary Occupation | Audit Committee |

Compensation Committee |

Nominating

| ||||||||||||||

|

C. Dean Metropoulos |

70 | III | 2019 | 2016 | Chairman and Chief Executive Officer of Metropoulos & Co. | — | — | — | ||||||||||||||

|

Andrew Jhawar* |

45 | I | 2017 | 2016 | Senior Partner at Apollo Management, L.P. | — | — | — | ||||||||||||||

|

Mark R. Stone |

53 | I | 2017 | 2016 | Senior Managing Director of The Gores Group | — | — | — | ||||||||||||||

|

Laurence Bodner |

54 | III | 2019 | 2016 | Chief Financial Officer of Sovos Brands | X | X (Chair) |

— | ||||||||||||||

|

Neil P. DeFeo |

71 | III | 2019 | 2016 | Corporate Advisor | — | X | X (Chair) | ||||||||||||||

|

Jerry D. Kaminski |

60 | II | 2018 | 2016 | Executive Vice President and Chief Operating Officer of the Land O’Lakes Inc. International business | X | X | X | ||||||||||||||

|

Craig D. Steeneck |

59 | II | 2018 | 2016 | Executive Vice President and Chief Financial Officer of Pinnacle Foods Inc. | X (Chair) |

— | X | ||||||||||||||

*Mr. Jhawar is not standing for re-election. Our board of directors has nominated Mr. Toler, our President and Chief Executive Officer, for election to the Board as a Class I director for a term expiring at the 2020 annual meeting of stockholders.

10

Our second amended and restated certificate of incorporation and our amended and restated bylaws provide for a classified board of directors with staggered three-year terms, consisting of the three classes as follows:

| Class

|

Director

|

Independent

| ||

| Class I (term expires at 2017 annual meeting) |

Andrew Jhawar* | No | ||

| Mark R. Stone | No | |||

| Class II (term expires at 2018 annual meeting) |

Jerry D. Kaminski | Yes | ||

| Craig D. Steeneck | Yes | |||

| Class III (term expires at 2019 annual meeting) |

C. Dean Metropoulos | No | ||

| Laurence Bodner | Yes | |||

| Neil P. DeFeo | Yes | |||

*Mr. Jhawar is not standing for re-election. Our board of directors has nominated Mr. Toler, our President and Chief Executive Officer, for election to the Board as a Class I director for a term expiring at the 2020 annual meeting of stockholders.

Our board of directors has determined that Messrs. Kaminski, Steeneck, Bodner and DeFeo each qualify as an “independent director,” as defined in the corporate governance rules of the Nasdaq Capital Market.

Only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors.

The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company.

Currently, our leadership structure separates the roles of Executive Chairman of the Board and Chief Executive Officer, with Mr. Metropoulos serving as our Executive Chairman and Mr. Toler serving as our President and Chief Executive Officer. Our board believes that separating these roles provides the appropriate balance between strategy development, flow of information between management and the board of directors, and oversight of management. We believe this provides guidance for our board of directors, while also positioning our Chief Executive Officer as the leader of the Company in the eyes of our customers, employees, and other stakeholders. As Executive Chairman, Mr. Metropoulos, among other responsibilities, presides over regularly scheduled meetings of the board, serves as a liaison between the directors, and performs such additional duties as our board of directors may otherwise determine and delegate. By having Mr. Metropoulos serve as Executive Chairman of the Board, Mr. Toler is better able to focus his attention on running our Company.

The Board’s Role in Risk Oversight

Although our management is primarily responsible for managing our risk exposure on a daily basis, our board of directors oversees the risk management processes. Our board, as a whole, determines the appropriate level of risk for our Company, assesses the specific risks that we face, and reviews management’s strategies for adequately mitigating and managing the identified risks. Although our board administers this risk management oversight function, our Audit Committee supports our board in discharging its oversight duties and addresses risks inherent in its area.

11

Prior to the Business Combination, our board consisted of four directors: Alec Gores, Randall Bort, William Patton and Jeffrey Rea, each of whom resigned upon the consummation of the Business Combination. Our board of directors held eleven meetings and acted through written consent three times in fiscal 2016 prior to the Business Combination. Following the Business Combination, our board of directors held one meeting in fiscal 2016, which was attended by each of our directors then serving. During fiscal 2016, each of our directors attended at least a majority of the meetings of our board of directors and of the committees on which he serves or served. No individual served as a director both prior to and following the Business Combination. We regularly schedule executive sessions in which independent directors meet without the presence or participation of management.

Our board of directors has the authority to appoint committees to perform certain oversight and other functions as directed by the board. Our board of directors has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by the board of directors.

Audit Committee

Our Audit Committee provides oversight of our accounting and financial reporting process, the audit of our financial statements and our internal control function. Among other matters, the Audit Committee is responsible for the following:

| • | appointing, compensating, retaining and overseeing the independent auditor; determining the compensation and oversight of the work of the independent auditor for the purpose of preparing or issuing an audit report or related work; |

| • | pre-approving all audit services and permitted non-audit services to be performed by our independent auditor, including the fees and terms of the services to be performed; |

| • | reviewing the qualifications and performance of the independent auditor and evaluating the independence of the independent auditor; |

| • | reviewing and discussing with management and the auditors the annual audit plan and the information which is required to be reported by the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting); |

| • | reviewing and discussing with management and the auditors the Company’s accounting and internal control policies; |

| • | discussing with management major risk assessment and risk management policies; |

| • | reviewing and discussing with management and the independent auditor the annual audited financial statements, and recommending to the board whether the audited financial statements should be included in our Form 10-K and Form 10-Q; |

| • | discussing with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of our financial statements; |

| • | inquiring and discussing with management our compliance with applicable laws and regulations; |

12

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or reports which raise material issues regarding our financial statements or accounting policies; and |

| • | reviewing and approving all related-party transactions. |

Our Audit Committee has the authority to retain advisors as the committee deems appropriate. Our Audit Committee is comprised of Craig D. Steeneck, the chair of the committee, Laurence Bodner and Jerry D. Kaminski. Prior to the Business Combination, Mr. Randall Bort, Mr. William Patton and Mr. Jeffrey Rea served as members of our Audit Committee. All members of our Audit Committee qualify as independent directors according to the rules and regulations of the SEC and Nasdaq with respect to audit committee membership. Mr. Steeneck is an “audit committee financial expert,” as such term is defined in Item 401(h) of Regulation S-K. Our Audit Committee has a written charter that sets forth our Audit Committee’s purpose and responsibilities.

Our Audit Committee acted through written consent one time during fiscal 2016 prior to the Business Combination and met one time during fiscal 2016 following the Business Combination.

Compensation Committee

Our Compensation Committee adopts, administers and reviews the compensation policies, plans and benefit programs for our executive officers and all other members of our executive team. Our Compensation Committee also oversees succession planning with respect to our management team. Our Compensation Committee is also responsible for the duties set forth in its written charter, including:

| • | reviewing key employee compensation goals, policies, plans and programs; |

| • | evaluating the performance of our Chief Executive Officer and other executive officers; |

| • | reviewing and approving the compensation of our Chief Executive Officer and other executive officers; |

| • | reviewing and approving employment agreements, severance arrangements and other similar arrangements between us and our executive officers; |

| • | evaluating director compensation; |

| • | reviewing employee benefit plans and perquisites; |

| • | administering our stock plans and other incentive compensation plans; |

| • | preparing the Compensation Committee Report in accordance with the rules and regulations of the SEC; and |

| • | overseeing our regulatory compliance with respect to compensation matters. |

Our Compensation Committee is comprised of Laurence Bodner, the chair of the committee, Neil P. DeFeo and Jerry D. Kaminski. Prior to the Business Combination, Messers Bort and Patton served on our Compensation Committee. Messrs. Bodner, DeFeo and Kaminski are independent directors according to the rules and regulations of the SEC and Nasdaq with respect to compensation committee membership. Our Compensation Committee has a written charter that sets forth the Compensation Committee’s purpose and responsibilities.

Our Compensation Committee did not meet during fiscal 2016 prior to the Business Combination and met one time during fiscal 2016 following the Business Combination.

Our Compensation Committee has the authority to retain advisors as the committee deems appropriate. The Compensation Committee has engaged Mercer, see “Post-Business Combination Compensation Committee Actions.”

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other things, making recommendations regarding corporate governance, the composition of our board of directors, identification,

13

evaluation and nomination of director candidates and the structure and composition of committees of our board of directors. In addition, our nominating and corporate governance is responsible for:

| • | developing and assessing criteria and qualifications for membership on our board and its committees; |

| • | identifying, recruiting, evaluating and screening individuals qualified to become members of our board and its committees, consistent with criteria approved by our board; |

| • | selecting, or recommending that the board select, the director nominees; |

| • | recommending to the board director nominees to fill vacancies on the board, as necessary; |

| • | reviewing, assessing and recommending nominees for membership on, and chairmanship of, the various committees of the board; |

| • | overseeing compliance with our corporate governance policies; |

| • | reviewing and recommending to our board any amendments to our corporate governance policies; and |

| • | overseeing the evaluation of the board and management and making recommendations to improve performance. |

Our Nominating and Corporate Governance Committee has the authority to retain advisors as the committee deems appropriate. Our Nominating and Corporate Governance Committee is comprised of Neil P. DeFeo, the chair of the committee, Jerry D. Kaminski and Craig D. Steeneck. Our Nominating and Corporate Governance Committee has a written charter that sets forth the committee’s purpose and responsibilities.

Our Nominating and Corporate Governance Committee was created following the Business Combination and did not meet during fiscal 2016.

Identifying and Evaluating Director Candidates

Our Nominating and Corporate Governance Committee will consider persons recommended by stockholders for inclusion as nominees for election to our board of directors. Stockholders wishing to recommend director candidates for consideration by the Nominating and Corporate Governance Committee may do so by writing to the Secretary at 1 E. Armour Boulevard, Kansas City, Missouri 64111, and giving the recommended nominee’s name, biographical data and qualifications, accompanied by the written consent of the recommended nominee.

The evaluation process for director nominees who are recommended by our stockholders is the same as for any other nominee and is based on numerous factors that our nominating and corporate governance committee considers appropriate, some of which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity reflecting ethnic background, gender and professional experience, and the extent to which the nominee would fill a present need on our board of directors.

While we do not have a formal policy outlining the diversity standards to be considered when evaluating director candidates, our objective is to foster diversity of thought on our board of directors. To accomplish that objective, the Nominating and Corporate Governance Committee considers ethnic and gender diversity, as well as differences in perspective, professional experience, education, skill, and other qualities in the context of the needs of our board of directors. Nominees are not to be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability, or any other basis prohibited by law. The Nominating and Corporate Governance Committee evaluates its effectiveness in achieving diversity on the board of directors through its annual review of board member composition.

14

Availability of Corporate Governance Information

Our board of directors has adopted charters for our Audit, Compensation, and Nominating and Corporate Governance Committees describing the authority and responsibilities delegated to the committee by our board of directors. Our board of directors has also adopted a code of ethics that applies to all of our employees, including our executive officers and directors, and those employees responsible for financial reporting. We post on our website, at www.hostessbrands.com under the “Investors” tab, the charters of our Audit, Compensation, and Nominating and Corporate Governance committees and the code of ethics referenced above. A copy of the code of ethics has been provided to each member of our management team. We intend to disclose any amendments to our code, or any waivers of its requirements, on our website to the extent required by applicable SEC or Nasdaq rules. The inclusion of our website address in this proxy statement does not include or incorporate by reference the information on or accessible through our website into this proxy statement. These documents are also available in print to any stockholder requesting a copy in writing from our Secretary at 1 E. Armour Boulevard, Kansas City, Missouri 64111.

Communications with our Board of Directors

Stockholders and other interested parties wishing to communicate with our board of directors or with an individual member of our board of directors may do so by writing to our board of directors or to the particular member of our board of directors, and mailing the correspondence to our Secretary at 1 E. Armour Boulevard, Kansas City, Missouri 64111. All such communications will be forwarded to the appropriate member or members of our board of directors, or if none is specified, to the Executive Chairman of our board of directors.

15

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees

Our Nominating and Corporate Governance Committee recommended, and the board of directors nominated:

| • | Mark R. Stone |

| • | William D. Toler |

as nominees for election as Class I members of our board of directors. Mr. Stone is presently a Class I director of our Company and Mr. Toler is currently the President and Chief Executive Officer of our Company, but not a member of the board of directors. Each nominee and has consented to serve a three-year term if elected, concluding at the 2020 annual meeting of stockholders. Biographical information about each of our directors, including Mr. Stone, is contained in the section above. Biographical information about Mr. Toler is contained in the section entitled “Executive Officers.” We believe that Mr. Toler’s extensive management experience in the consumer packaged goods industry makes him well-qualified to serve as a director on our board. At the Annual Meeting, two directors will be elected to our board of directors.

Required Vote

The two nominees receiving the highest number of affirmative “FOR” votes shall be elected as directors. Unless marked to the contrary, proxies received will be voted “FOR” each of these two nominees.

Recommendation of the Board

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF EACH OF THE ABOVE-NAMED NOMINEES.

16

In connection with the Business Combination, our board of directors approved a compensation policy for our independent directors. Under this policy, independent directors receive an annual cash retainer of $60,000, payable quarterly, an annual equity award with a grant date value of $77,000 that vests annually and reimbursement of expenses relating to attendance at board and committee meetings. Members of our Audit Committee receive an additional annual cash retainer of $10,000 and the chairperson of our Audit Committee receives an additional cash retainer of $20,000. Members of our Compensation Committee receive an additional annual cash retainer of $6,500 and the chairperson of our Compensation Committee receives an additional cash retainer of $15,000. Members of our Nominating and Governance Committee receive an additional annual cash retainer of $4,000 and the chairperson of our Nominating and Governance Committee receives an additional cash retainer of $10,000.

In respect of their annual equity awards for service commencing with the closing of the Business Combination, on January 25, 2017, our independent directors each received an award in the form of 5,683 restricted stock units (“RSUs”). The number of shares is based upon a value of $77,000, divided by the average closing price of our Class A common stock over the 20 trading day period preceding the date of grant rounded to the nearest share. The shares underlying the RSUs will vest on November 4, 2017, the anniversary of the Business Combination, subject to earlier vesting in connection with death or disability or a change of control and will be paid in the form of shares on a director’s cessation of service on the board, or if earlier, a change of control. Because our board believes that it is appropriate for annual equity awards to our independent directors to be made on or around the time of each annual meeting of stockholders, our board anticipates making an additional grant of RSUs at or about the time of our Annual Meeting. Such additional grant will vest on the date of our 2018 Annual Meeting of Stockholders (subject to earlier vesting under certain circumstances), pro-rated for the period of time between the first anniversary of the Business Combination and the date of our 2018 Annual Meeting of Stockholders. Thereafter, our board anticipates that annual equity awards will be made on or around the time of each Annual Meeting of Stockholders.

Director Compensation Table

The following table sets forth a summary of the compensation paid to our directors, other than our Executive Chairman, which compensation is disclosed elsewhere in this proxy statement, for service in fiscal 2016.

| Name |

Fees Earned or Paid in Cash |

Share Awards (1) |

Option Awards

|

All Other Compensation

|

Total | |||||||||||||||

| Laurence Bodner |

$ | 13,396 | $ | 83,654 | - | - | $ | 97,050 | ||||||||||||

| Neil P. DeFeo |

12,056 | 83,654 | 95,710 | |||||||||||||||||

| Jerry D. Kaminski |

12,687 | 83,654 | - | - | 96,341 | |||||||||||||||

| Craig D. Steeneck |

13,238 | 83,654 | - | - | 96,892 | |||||||||||||||

| (1) | Consists of 5,683 shares at the closing price of $14.72 per share on the date of grant (January 25, 2017). The number of shares is based upon a value of $77,000 divided by the 20 trading day average closing price per share for the period preceding the date of grant (January 25, 2017) rounded to the nearest share. |

17

The following table lists all outstanding equity awards held by our directors, other than our Executive Chairman, which awards are disclosed elsewhere in this proxy statement, as of April 21, 2017.

| Name | Date of Grant (1) | Number of Shares of Stock That Have Not Vested (2) |

Market Value of Shares of Stock That Have Not Vested (3) |

|||||||||

| Laurence Bodner |

January 25, 2017 | 5,683 | 83,654 | |||||||||

| Neil P. DeFeo |

January 25, 2017 | 5,683 | 83,654 | |||||||||

| Jerry D. Kaminski |

January 25, 2017 | 5,683 | 83,654 | |||||||||

| Craig D. Steeneck |

January 25, 2017 | 5,683 | 83,654 | |||||||||

| (1) | Stock awards granted on January 25, 2017 as the initial equity awards for the directors joining the board after the consummation of the Business Combination in fiscal 2016. |

| (2) | Stock awards represent RSUs which will vest upon the first to occur of (i) November 4, 2017, (ii) the death or disability of the director or (iii) a change of control of the Company, in the case of (i) and (iii), subject to continued service until such vesting date. |

| (3) | Consists of 5,683 shares at the closing price of $14.72 per share on the date of grant (January 25, 2017). The number of shares is based upon a value of $77,000 divided by the 20 trading day average closing price per share for the period preceding the date of grant (January 25, 2017) rounded to the nearest share. |

18

The following table sets forth information regarding our executive officers as of April 21, 2017:

| Age | Position | |||||

| C. Dean Metropoulos |

70 | Executive Chairman | ||||

| William D. Toler |

57 | President, Chief Executive Officer | ||||

| Thomas A. Peterson |

44 | Executive Vice President, Chief Financial Officer | ||||

| Michael J. Cramer |

64 | Executive Vice President, Chief Administrative Officer | ||||

| Andrew W. Jacobs |

49 | Senior Vice President, Chief Customer Officer | ||||

| Stuart A. Wilcox |

56 | Senior Vice President, Chief Operating Officer | ||||

| Burke E. Raine |

37 | Senior Vice President, Chief Marketing Officer | ||||

| Jolyn J. Sebree |

45 | Senior Vice President, General Counsel | ||||

| Darryl P. Riley |

57 | Senior Vice President of Quality/Food Safety and R&D | ||||

C. Dean Metropoulos’ biography is set forth under the heading “Our Board” above.

William D. Toler. Mr. Toler has served as our President and Chief Executive Officer since the consummation of the Business Transaction and served in the same capacity at Hostess Brands, LLC since April 2014. He brings more than 30 years of consumer packaged goods industry experience to the Company. Prior to joining Hostess Brands, LLC, he worked as an operating partner at Oaktree Capital from October 2013 to April 2014. Prior to that, he served from September 2008 to September 2013 as the Chief Executive Officer of AdvancePierre Foods, Inc., a leading supplier of value-added protein and hand-held convenience products to the food service, school, retail, club, vending and convenience store markets. Prior to joining AdvancePierre, Mr. Toler was President of Pinnacle Foods from July 2005 to September 2008. He has also held key positions at ICG Commerce, Campbell Sales Company, Nabisco, Reckitt & Colman and Procter & Gamble.

Thomas A. Peterson. Mr. Peterson has served as our Executive Vice President, Chief Financial Officer since the consummation of the Business Combination and served in the same roles at Hostess Brands, LLC since March 2016. Prior to that he was employed at Hostess Brands, LLC as the Senior Vice President and Corporate Controller from April 2013 through February 2016. Prior to that, he served as a Managing Director for FTI Consulting from March 2011 to April 2013. Prior to this role, from January 2009 to March 2011, he served as a Director for FTI Consulting.

Michael J. Cramer. Mr. Cramer has served as our Executive Vice President, Chief Administrative Officer since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since April 2013. Mr. Cramer has served as Vice President at CDM Hostess Class C, LLC and Vice President at Hostess CDM Co-Invest, LLC since April 2013. In addition, Mr. Cramer has served as the Vice President at Fairmont Aviation LLC since April 2013. From June 2010 through November 2014, he served as Senior Vice President and Director of Pabst Brewing Company. From March 2004 through June 2008, he served as Executive Vice President for Pinnacle Foods.

Andrew W. Jacobs. Mr. Jacobs has served as our Senior Vice President, Chief Customer Officer since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since September 2014. Prior to this role, he was employed at Hostess Brands, LLC as the Senior Vice President, Strategic Channels from February 2014 through September 2014. From September 2012 until February 2014, he served as President of Wolfgang Candy Company. From September 2003 through May 2012, he served as Vice President and General Manager (US Customers) for The Hershey Company. In 2015, Mr. Jacobs and his brother were found jointly and severally liable by the U.S. District Court of Northern Ohio for a civil violation of Exchange Act Rule 14e-3(a) in connection with a stock purchase made by Mr. Jacob’s brother in 2009. Mr. Jacob’s brother was required to disgorge approximately $50,000 in profits related thereto and each were enjoined from future violations of Rule 14e-3.

19

Stuart A. Wilcox. Mr. Wilcox has served as our Senior Vice President, Chief Operating Officer since the consummation of the Business Combination and served in the same roles at Hostess Brands, LLC since October 2015. From January 2014 through October 2015, he served as Senior Vice President of Operations for Goldenstate Foods. From January 2012 through January 2014, he served as Senior Vice President of Operations for The Original Cakerie. From April 2009 through January 2012, he served as the Vice President of Operations for Chiquita/Fresh Express.

Burke E. Raine. Mr. Raine has served as our Senior Vice President, Chief Marketing Officer since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since March 2016. From February 2014 through March 2016, he served as Vice President, Marketing for Diamond Foods, Inc. Prior to this position, he served as Senior Director of Marketing for Diamond Foods, Inc. from July 2013 through January 2014. From February 2012 through June 2013, he served as Director of Marketing for PEPSICO. Prior to this role, he was employed at PEPSICO as Senior Marketing Manager from February 2009 through February 2012.

Jolyn J. Sebree. Ms. Sebree has served as our Senior Vice President, General Counsel and Secretary since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since April 2013. From March 2012 through April 2013, she served as Senior Vice President, Acting General Counsel and Corporate Secretary at Old Hostess. Prior to this role, she served as Vice President, Assistant General Counsel at Old Hostess from August 2011 to March 2012.

Darryl P. Riley. Mr. Riley has served as our Senior Vice President of Quality/Food Safety and R&D since December 2016. From April 2016 to December 2016, Mr. Riley served as President of Total Food Safety Management, overseeing Quality and Food Safety. Prior to this position he served as Vice President, R&D, Quality, & Innovation at Kraft Foods Company from September 2013 to August 2015. From July 2004 through August 2013, he served as Vice President, Research, Quality, & Technology at the Kellogg Company.

Each of our executive officers serves at the discretion of our board of directors and holds office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal. There are no family relationships among any of our directors or executive officers.

Compensation Committee Interlocks and Insider Participation

Since November 4, 2016, our Compensation Committee has been comprised of Laurence Bodner, Neil P. DeFeo and Jerry D. Kaminski. None of these individuals had any contractual or other relationships with us during such time except as directors, nor have any of these individuals ever been an officer or employee of our Company.

None of our executive officers currently serves, or in the past year has served, as a member of the board or compensation committee of any entity that has one or more executive officers serving on our board or Compensation Committee.

20

The following tables provide information regarding the compensation of our named executive officers for fiscal 2016 and 2015.

| Name and Principal Position |

Fiscal Year |

Salary | Bonus (2) |

Stock Awards |

Option Awards |

Non-Equity Plan |

Non-Qualified Deferred Compensation Earnings |

All Other Compensation (5) |

Total | |||||||||||||||||||||||||||

| C. Dean Metropoulos |

2016 | $ | 1,324,731 | (1) | $ | - | $ | 58,107,120 | (3) | - | - | - | $ | 2,378,149 | $ | 63,926,960 | ||||||||||||||||||||

| Executive Chairman |

2015 | 1,500,000 | 270,000 | - | - | - | - | 2,553,664 | 4,323,664 | |||||||||||||||||||||||||||

| William D. Toler |

2016 | 417,688 | 624,449 | - | - | 422,300 | - | 62,218 | 1,526,655 | |||||||||||||||||||||||||||

| President and Chief Executive Officer |

2015 | 406,692 | 92,700 | - | - | - | - | 85,477 | 584,869 | |||||||||||||||||||||||||||

| Andrew W. Jacobs |

2016 | 317,165 | - | - | - | 192,900 | - | 8,594 | 518,659 | |||||||||||||||||||||||||||

| Senior Vice President, Chief Customer Officer |

2015 | 307,978 | 56,200 | - | - | - | - | 9,620 | 373,798 | |||||||||||||||||||||||||||

| (1) | Following the Business Combination, Mr. Metropoulos does not receive significant cash compensation and bonuses as he is primarily compensated in stock. |

| (2) | Reflects discretionary bonuses paid for services performed in 2015 and bonuses paid to Mr. Toler related to the Business Combination. |

| (3) | Consists of 5,246,000 shares subject to stock awards granted upon the closing of the Business Combination on November 4, 2016. Of the 5,246,000 shares, (a) 2,496,000 shares were issued on the Closing Date and are vested but remain subject to transfer restrictions until November 4, 2017 and (b) 2,750,000 shares are issuable upon achievement of earn-out targets for the 2018 fiscal year, as specified in the Executive Chairman Employment Agreement (refer to the table below in “—Outstanding Equity Awards at Fiscal Year End” for a description of these targets). The shares subject to the restriction are valued at approximately $10.72 per share based on the average trading price on the Closing Date of $11.40, discounted for the post-vesting transfer restriction. The remaining 2,750,000 shares are valued based on the average trading price on the Closing Date of $11.40 and are not discounted since there are no post-vesting trading restrictions. |

| (4) | 2016 bonuses were paid pursuant to the terms of our short-term incentive plan. For a discussion of the Company’s performance-based cash incentive compensation program, see “2016 Compensation Programs” below. |

| (5) | All Other Compensation is comprised of Company matching contributions under Hostess’ 401(k) plan which is a tax-qualified defined contribution plan, life insurance premiums, aircraft expense, automobile expense, travel expenses and cell phone allowance. The following table summarizes “All Other Compensation” provided to the named executive officers during the years ended December 31, 2015 and December 31, 2016: |

| Fiscal Year |

401(k) Match |

Life Insurance Premiums |

Aircraft (1) | Automobile (2) | Travel Expenses |

Cell Phone Allowance |

Total | |||||||||||||||||||||||||

| C. Dean Metropoulos |

2016 | $ | 7,950 | $ | 2,082 | $ | 2,335,923 | $ | 32,194 | $ | -- | $ | -- | $ | 2,378,149 | |||||||||||||||||

| 2015 | 7,950 | 2,339 | 2,500,000 | 43,375 | -- | -- | 2,553,664 | |||||||||||||||||||||||||

| William D. Toler |

2016 | 7,950 | 764 | -- | -- | 52,464 (3) | 1,040 | 62,218 | ||||||||||||||||||||||||

| 2015 | 7,950 | 1,806 | -- | -- | 74,681 (3) | 1,040 | 85,477 | |||||||||||||||||||||||||

| Andrew W. Jacobs |

2016 | 7,287 | 267 | -- | -- | -- | 1,040 | 8,594 | ||||||||||||||||||||||||

| 2015 | 7,950 | 630 | -- | -- | -- | 1,040 | 9,620 | |||||||||||||||||||||||||

| (1) | This column represents the amount Hostess paid for use of a private aircraft in accordance with Mr. Metropoulos’ employment agreement. Following the Business Combination, reimbursement of Mr. Metropoulos’ aircraft expenses is limited to $25,000 per month. |

21

| (2) | This column represents annual aggregate incremental costs associated with the provision of an automobile as provided in Mr. Metropoulos’ employment agreement, consisting of depreciation, maintenance, insurance, and registration expenses. |

| (3) | Reimbursement of travel expenses to and from Mr. Toler’s home to the Company’s headquarters in Kansas City, Missouri. |

Our senior executive team is comprised of individuals with significant experience leading and growing packaged foods firms. We believe our expertise in managing brands (led by Mr. Metropoulos) and experience in operating packaged food businesses (under Mr. Toler’s leadership) gives us the specialized tools to position the Company as an attractive vehicle for future growth within the snacking universe.

The discussion below is intended to provide a summary overview of the compensation programs in place prior to the Business Combination and the compensation decisions taken in relation to 2016 performance achieved. In addition, the Company has outlined the compensation plans adopted for 2017, as well as the process undertaken to define the 2017 compensation programs.

2016 Compensation Programs

Prior to the Business Combination, the officers of Hostess received salaries and participated in both a short- and long-term incentive plan.

Annual Incentive Compensation Program

Aggregate bonus opportunities under the short-term incentive plan were set annually by the board of Hostess and the target levels of performance were determined based on internal planning and forecasting processes. For 2016, the Compensation Committee determined that Hostess achieved the Revenue, Gross Margin, and EBITDA goals that were established under its short-term incentive plan. As such, bonuses were paid at target for 2016. In addition, Mr. Toler received an incremental bonus of $375,000 to recognize his leadership through the pre- Business Combination period and for the Business Combination and related transactions.

Equity-Based Incentive Compensation Program

Prior to the Business Combination, Hostess maintained the 2013 Hostess Management Equity Incentive Plan, as amended (“2013 Plan”) to support multiple objectives, including (i) aligning executives’ interests with those of its unit holders, (ii) ensuring that realized compensation reflects changes in unit holder value over the long term, thereby mitigating incentives for executives to pursue short-term objectives at the expense of long-term value creation, and (iii) attracting, motivating, rewarding, and retaining highly skilled executives.

Hostess Management, LLC, an entity owned, directly or indirectly, by members of Hostess management and certain of the equity owners of Hostess prior to the Business Combination (“Hostess Management”), was formed to serve as a vehicle through which members holding class B units (“Members”) thereof may receive incentive equity in respect to Hostess. Hostess Management directly or indirectly owned approximately 9% of the equity interests in the operating subsidiaries of Hostess immediately prior to the Business Combination. In October 2013, the Plan committee, consisting of two members designated pursuant to the Plan, awarded grants of 783,756 Class B units in Hostess Management to certain members of management under the Plan. In July 2014, the Plan committee awarded grants of 97,200 Class B units and a grant of 183,219 Class B-1 units to certain members of management. There were no equity awards granted during 2015. In March 2016, the Plan committee awarded grants of 593,630 Class B units to certain members of management, including a grant of 183,219 Class B-1 units to Mr. Toler and 65,787 Class B units and 7,501 Class B-2 units to Mr. Jacobs.

For more information about the treatment of such equity awards in the Business Combination, see “Executive Compensation – Hostess — Impact of the Master Transaction Agreement” in our Definitive Proxy Statement on Schedule 14A with respect to the Business Combination filed with the SEC on October 21, 2016.

22

Hostess Management merged with and into Hostess Holdings as part of the Business Combination and the 2013 Plan was terminated. See “2017 Compensation Programs – Long-Term Incentive Plan” for a description of the 2016 Equity Incentive Plan, adopted in connection with the Business Combination, that replaced the 2013 Plan as the Company’s principal equity incentive plan.

Base Salaries

For 2016, the base salaries for the senior executives of Hostess were established based on the scope of their responsibilities, taking into account relevant experience, internal pay equity, tenure, Hostess’s ability to replace the individual, and other factors deemed relevant.

Post-Business Combination Compensation Committee Actions

Following the Business Combination, no long-term incentive awards remained outstanding and unvested for our executive officers, except for the awards granted to Mr. Metropoulos pursuant to his employment agreement, described below. Accordingly, on March 23, 2017, the Compensation Committee approved new executive compensation plans and policies for its executive officers that the Compensation Committee deemed appropriate for a public company of its complexity and in the packaged food sector. In order to define a go-forward compensation program to effectively attract, motivate, and retain a senior leadership team that can drive business success while being aligned with appropriate competitive and stockholder considerations, the Company engaged in a robust internal and external review with the advice of its outside independent advisor, Mercer. The Compensation Committee conducted an assessment of Mercer’s independence and concluded that Mercer is independent. In this review, the Compensation Committee, with the advice of Mercer:

| • | Established a pay philosophy; |

| • | Defined a peer group of firms that aligned with the Company’s business size and complexity, as well as being in the packaged food sector; |

| • | Assessed competitive pay levels and practices at the defined peer group; and |

| • | Developed go-forward pay levels, incentive plan designs, and pay policies that: |

| ○ | Provide competitive award opportunities; |

| ○ | Align with market and stockholder-appropriate practices; and |

| ○ | Create strong incentives to drive business performance and stockholder value creation. |

Pay Philosophy

The Company’s pay philosophy has been established to allow it to attract and retain talented senior leaders that can drive business success and create stockholder value. Key aspects of the pay strategy are to:

| • | Target an overall pay level that is competitive in the market; |

| • | Emphasize pay for performance with clear objectives and strong alignment between results and pay delivered; and |

| • | For senior executives, provide a significant focus on long-term performance achievement that is aligned with stockholder outcomes. |

The Compensation Committee reviews management pay on a total compensation basis with a stronger focus on pay for performance and creation of stockholder value for members of senior management. For 2017, in excess of 70% of senior management’s (Senior Vice President and above) total target compensation is based on achievement of Compensation Committee approved performance criteria and/or the share price of our Class A common stock with the goal of driving Company performance and creating stockholder value.

Peer Group

The Company has established a peer group of firms in similar business sectors, notably packaged foods and beverages. The peers selected are of a comparable size and complexity. Factors such as EBITDA, revenue, and market capitalization were considered in selecting peer firms. The Company’s peer group is comprised of 12 firms, including B&G Foods, Inc., Blue Buffalo Pet Products, Inc., Farmer Bros. Co., Flower Foods, Inc., John

23