Exhibit 99.1

FORWARD-LOOKING STATEMENTS

This Exhibit 99.1 contains statements reflecting our views about our future performance that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. All statements contained other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. Statements that constitute forward-looking statements are generally identified through the inclusion of words such as “believes,” “expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,” “plan,” “may,” “should,” or similar language. Statements addressing our future operating performance and statements addressing events and developments that we expect or anticipate will occur are also considered as forward-looking statements. All forward-looking statements included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein are made only as of the date thereof. It is routine for our internal projections and expectations to change throughout the year, and any forward-looking statements based upon these projections or expectations may change prior to the end of the next quarter or year. Investors are cautioned not to place undue reliance on any such forward-looking statements. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by those forward-looking statements. Risks and uncertainties are identified and discussed in “Risk Factors” in our filings with the Securities and Exchange Commision. All subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

EXPLANATORY NOTE

Hostess Brands, Inc. (f/k/a Gores Holdings, Inc.) was originally incorporated in Delaware on June 1, 2015 as a special purpose acquisition company, or a SPAC, formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or other similar business combination with one or more target businesses. On August 19, 2015, Gores Holdings, Inc. consummated its initial public offering (the “IPO”), following which its securities began trading on the Nasdaq Capital Market (“Nasdaq”).

On November 4, 2016 (the “Acquisition Date”), in a transaction referred to as the “Business Combination,” Gores Holdings, Inc. acquired a controlling interest in Hostess Holdings, L.P. (“Hostess Holdings”), an entity owned indirectly by entities controlled by C. Dean Metropoulos and certain equity funds managed by affiliates of Apollo Global Management, LLC (the “Apollo Funds”). Hostess Holdings had acquired the Hostess brand and certain strategic assets out of the bankruptcy liquidation proceedings of its prior owner (“Old Hostess”), free and clear of all past liabilities, in April 2013, and relaunched the Hostess brand later that year.

In connection with the closing of the Business Combination, Gores Holdings, Inc. changed its name to “Hostess Brands, Inc.” and its trading symbols on Nasdaq from “GRSH,” and “GRSHW,” to “TWNK” and “TWNKW”.

Following the Business Combination, Mr. Metropoulos and entities controlled by him (the “Metropoulos Entities”) and the Apollo Funds continued as stockholders and Mr. Metropoulos became Executive Chairman of Hostess Brands, Inc. The Apollo Funds and the Metropoulos Entities are among the Selling Stockholders in this offering. See “Selling Stockholders.”

Unless the context otherwise requires, “we,” “us,” “our” and the “Company” refer, for periods prior to the completion of the Business Combination, to Hostess Holdings and its subsidiaries and, for periods upon or after the completion of the Business Combination, to Hostess Brands, Inc. and its subsidiaries, including Hostess Holdings and its subsidiaries. Our “Sponsor” refers to Gores Sponsor, LLC, a Delaware limited liability company and the principal stockholder of Gores Holdings, Inc. prior to the Business Combination, and the “The Gores Group” refers to The Gores Group LLC, an affiliate of our Sponsor. “Metropoulos Entities” refers to our Executive Chairman, C. Dean. Metropoulos and entities controlled by him that hold an equity stake in us. “Apollo Funds” refers to equity funds managed by affiliates of Apollo Global Management, LLC that indirectly hold an equity stake is us. “Legacy Hostess Equityholders” refer to the Apollo Funds and the Metropoulos Entities, collectively.

Excerpt from “Prospectus Supplement Summary”

Company Overview

Hostess® has been an iconic American brand for generations. We offer a variety of new and classic treats under the Hostess® brand including Twinkies®, Cupcakes, Ding Dongs®, Ho Hos®, Donettes®, and Zingers® among others. In April 2013, we acquired the Hostess® and Dolly Madison® brands out of the bankruptcy liquidation proceedings of their prior owners, free and clear of all prior liabilities, contracts, deferred taxes and other “legacy” issues. After a brief hiatus in production, we began providing Hostess products to retailer partners and consumers nationwide in July 2013. By combining Hostess’ strong reputation with innovative technology and a Direct-To-Warehouse (“DTW”) business model, we rapidly recaptured market share. In nearly four years, we have invested approximately $160 million to upgrade our manufacturing footprint, implement new IT systems and enhance production efficiency through the installation of automated baking and packaging lines. These investments, combined with our DTW distribution model, have reestablished Hostess’ leading, premium brand position in the $6.5 billion U.S. Sweet Baked Goods (“SBG”) category and have increased our distribution channels and paved new growth opportunities for the Company. For 2016, on a pro forma combined basis, we had net revenue of $727.6 million, net income of $82.4 million, and adjusted EBITDA of $215.3 million.

Our DTW distribution model uses centralized distribution centers and common carriers to fill orders, with products generally delivered to our customers’ warehouses. This model has eliminated the need for Direct-Store-Delivery (“DSD”) routes and drivers which has allowed us to expand our core distribution while gaining access to new channels (e.g., further penetration into convenience, drug store, dollar, foodservice, and cash & carry). We have both renewed and added relationships with trusted retailers around the country.

As a highly fragmented category in both the United States and internationally, SBG represents a significant opportunity for further consolidation. Our business model and efficient DTW route-to-market strategy, along with highly sophisticated and modern systems, provide an ideal platform for adding other branded snacks to our portfolio. We maintain a highly-disciplined outlook on acquisitions, focusing on opportunities with large addressable markets. In addition, we believe our expertise in managing brands (led by our Executive Chairman, Mr. Metropoulos) and experience in operating packaged food businesses (under the leadership of our President and Chief Executive Officer, Bill Toler) gives us the specialized tools to position the Company as an attractive vehicle for future growth within the snacking universe.

We have been actively investing in new product development and pursuing acquisitions to further leverage our strong brand and to expand into new categories and markets to drive incremental growth. In April 2015, we launched Hostess® branded bread and buns to capitalize on the strength of our brand and to expand our product assortment in the small format channels, including convenience and drug store channels.

In May 2016, we purchased 100% of the stock of Superior Cake Products, Inc. (“Superior”), to expand into the in-store bakery (“ISB”) section of grocery and club retailers. Retailers are increasingly utilizing in-store bakery goods to provide a differentiated shopping experience and to showcase product offerings. Superior manufactures éclairs, madeleines, brownies, and iced cookies, and also offers preservative-free and gluten-free products. We believe there is growth potential by expanding Hostess® product offerings within the ISB section of grocery and club retailers

The Industry Where Hostess Operates: Large and Attractive

Snacking is ubiquitous in the U.S. and continues to grow.

Nearly all U.S. consumers eat snacks at least once per day. According to Information Resources, Inc. (“IRI”), the average number of snacks consumed per person per day in the United States increased over 40%, from 1.9 to 2.7 between 2010 and 2015. The U.S. SBG category is one of the largest categories within the broader $110 billion U.S. snacking universe, with estimated retail sales of $6.5 billion in 2016 according to Nielsen U.S. total universe. The SBG category includes breakfast items (e.g., donuts, breakfast danishes, and muffins) and all-day snacking items (e.g., snack cakes, pies, bars, brownies, blondies, and cookies). According to The Nielsen Company, the Sweet Snacks category (Candy, Cookies, SBG) accounted for 50.4% of the Total Snacks category dollars, and is growing at 1.3% compared to Total Food & Beverage sales growth of 0.1% in 2016 vs the prior year. Hostess’ product offerings within the SBG category are characterized by highly impulse-driven purchase decisions, low price elasticity, and continued appeal across economic cycles. Hostess’ products benefit from increased snacking frequency driven by today’s busy lifestyles. According to IRI’s snacking survey, over 90% of consumers state that taste is important when looking for snacks, and Hostess is one of the leading providers of delectable and satisfying snack cakes in America. According to IRI’s 2016 “State of the Snack Food Industry” report, retail dollar sales of indulgent snacks in the U.S. grew 3.4% year over year, in-line with growth of the broader core snacks category and faster than the total retail food & beverage industry (2.9%). In fact, according to IRI, Hostess’ products participate in some of the fastest growing industry segments, such as Bakery Snacks (6.9% 2015 over 2014 growth) and donuts / pastries (6.7% 2015 over 2014 growth).

Hostess is a category and segment leader.

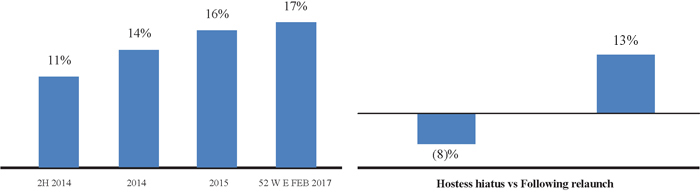

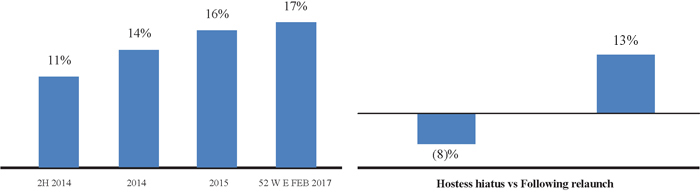

Hostess® is the second leading brand by market share within SBG. For the 52-week period ended February 25, 2017 our market share was 16.9% per Nielsen’s U.S. SBG category data. We have a #1 leading market position within the two largest SBG Segments; Donut Segment and Snack Cake Segment, and have a #2 leading market position in total Sweet Baked Goods, according to Nielsen U.S. total universe for the 52 weeks ended February 25, 2017. The Donut and Snack Cake Segments together account for 49% of the SBG categories’ total dollar sales. We believe that our importance to the SBG category is clearly evident through the sales decline the category experienced while Hostess® products were off store shelves. The U.S. SBG category contracted 8% during our hiatus, but subsequently grew to a 13% increase-a 21% point swing-during the 52 weeks ended February 25, 2017 period following our return. We have accounted for 76% of the category’s growth from the 52 weeks ended July 31, 2013 to the 52 weeks ended February 25, 2017. We account for 174.5% of the category’s growth in the latest 52 weeks ended February 25, 2017 vs. the prior year. All other brands contributed (74.5)% vs. one year ago.

| 1 | Source: Nielsen U.S. total universe |

| 2 | Source: Nielsen U.S. total universe, 12 weeks ended 10/13/2012 vs 12 weeks ended 1/26/13 |

| 3 | Source: Nielsen U.S. total universe, 52 weeks ended 07/06/2013 vs 52 weeks ended 2/25/17 |

Competitive landscape.

Hostess® is #2 in the U.S. SBG category. The top three brands account for 59% of the SBG retail sales according to Nielsen, while the rest of the category remains fairly fragmented. With limited private label penetration within the category (4% market share vs. 18%1 for overall packaged food), consumers have shown a strong preference for trusted brands within the SBG category. The leading positions are solidified through extensive product portfolios, strong brand awareness, established distribution capabilities and long-standing relationships with critical high-volume retailers. Furthermore, high levels of capital investment are required to establish manufacturing and distribution capabilities of meaningful scale, providing additional barriers to entry.

Consumers favor on-the-go breakfast consumption.

Over 50% of the $6.5 billion SBG category is the breakfast sub-category, consisting of donuts ($1.5 billion), breakfast sweet goods ($1.3 billion) and muffins ($482 million) according to Nielsen U.S. total universe for the 52 weeks ended February 25, 2017. Convenience and brand preference continue to influence snack selection, as over half of U.S. consumers rate portability as a key attribute in breakfast items as according to Mintel. These consumption trends play to our strengths as our products conveniently come packaged in both single-serve and multipack varieties. In addition, we have launched a line of Hostess whole grain mini muffins, jumbo muffins, danishes, and glazed donuts, which have been well-received as new breakfast offerings.

| 1 | Source: Nielsen U.S. total universe, 52 weeks ended 2/25/17 |

Our Competitive Strengths

Leading brands synonymous with American snacking.

We believe that we have maintained our brand power and category awareness for nearly a century by satisfying consumers’ need for fun, light-hearted treats. We believe our portfolio of highly recognized products is synonymous with American snacking, and there is perhaps no better indicator of this than our 90%+ brand awareness, according to a Harman Atchison study in 2014. We believe that we have established our leadership position in the SBG segment through the strength and quality of our products, developing and promoting a brand that unites our loyal consumer base and by pricing our products at a reasonable premium to other snacking alternatives.

We take great pride in baking an assortment of classic American treats such as Twinkies®, Donettes®, Cupcakes, Sno Balls®, Ding Dongs®, Zingers®, Ho Hos®, and Suzy Q’s®. Each brand has established its own identity and fan base, with brands appearing in movies, TV shows and other pop culture venues. We believe the Hostess brand is perceived as fun, dynamic, innovative and part of American popular culture. Our most famous brand, Twinkies® continues to gain visibility as a cultural icon including through successful campaigns around movie releases including X-Men, The Minions and the 2016 summer movie release, Ghostbusters. We currently have over 1.2 million Facebook fans and approximately 93,500 Twitter followers as well as prominent visibility on YouTube and Instagram.

Strong position at retailers.

We believe consumers and retailers alike recognize Hostess, and our breadth of products, as a leading brand and umbrella for the whole category. Our broad product portfolio offers the unique opportunity to expand shelf space, particularly in newly obtained and newly accessible channels. While Old Hostess was limited by its DSD model, we have been able to leverage the DTW model to expand our core distribution while gaining access to other whitespace channels (i.e., certain convenience, drug, dollar, foodservice, and cash & carry). As a result, we have both renewed and added relationships with trusted retailers around the country, once again stocking shelves with our products. We believe that our DTW model, along with the strength of our premium positioning, allows us to offer retailers attractive margins that incentivize further distribution of our products.

The New Hostess is an innovation engine.

When we relaunched Hostess, we set out to challenge the status quo business model of our competitors. We established our innovative DTW distribution model and heavily invested in machinery and equipment at our bakeries, which has resulted in energy, labor and time savings, along with the ability to achieve efficiently made quality products. These investments paved the way for new product innovation. Unlike Old Hostess, whose DSD model required new products to be manufactured on various lines in multiple facilities in order to facilitate distribution across the country, we can now leverage our existing infrastructure and produce new products on one line in one facility. Centralized production allows us to continually innovate and bring new products to market while not disrupting the production of our existing product portfolio.

We are devoted to maintaining our iconic brands while contemporizing in order to stay relevant with consumers into the future. We believe that to support our premium position, we must continually evolve with changing consumer preferences and trends. As such, we have created an infrastructure that allows us to remain flexible. Our new pre-built, retail-ready corrugated displays allow retailers to take full or partial pallets of product through our warehouses and have them ready for display. We continue to develop new flavors and platforms, and have a robust innovation pipeline that expands the Hostess brand across categories. Recent product launches include whole grain mini muffins, Suzy Q’s® snack cakes (a product re-launch), and Hostess Sweet ShopTM brownies. In August 2016, we launched a line of Deep Fried Twinkies® in the freezer aisle. Collectively, we believe our product launches have been successful and augmented our top line growth. Product launches in 2016 have resulted in pro forma combined net revenue of $44.0 million for the year ended December 31, 2016. In addition, the recent acquisition of Superior provides us a presence in the ISB category. Net revenue for Superior was $26.7 million for the period from the acquisition date of May 10, 2016 through December 31, 2016, and accounted for 4% of our pro forma combined net revenue for 2016.

DTW Distribution Model.

We believe our DTW distribution model has created a substantial whitespace opportunity, which is one of the key drivers that we expect to fuel our future growth. We have greater access to convenience, drug and dollar stores. Distributing to these channels under a DSD model can be inefficient due to small average drop size. Similarly, we have an opportunity to continue building distribution in the drug store channel after having successfully established a strong presence. Historically, DSD snack cake companies have competed with candy and tobacco distributors; however, our DTW model has enabled us to partner with these third-party distributors who can profitably penetrate both the convenience store and drug store channels and who are looking for opportunities to gain share in the SBG category. For 2016, convenience and drug stores accounted for 34.4% of pro forma combined net revenues. We have established a strong presence and market share in the drug store channel and are focused on continuously expanding coverage of convenience stores. These partnerships further expand our distribution reach in a highly efficient manner and we believe they will add to our growth potential going forward.

Highly efficient and profitable business model.

The DTW distribution model is a significant change from Old Hostess’ DSD system, which utilized company owned trucks and company employed union drivers to serve over 5,500 routes. Today all transportation and shipping is done through third-parties to warehouse locations. Transportation and distribution costs as a percentage of net sales have been reduced by nearly 1800 basis points, historically—34% and now running— 16% of net revenue.2 We are investing heavily in automation, which allows for improved product quality, consistency and efficiency. However, the benefits of our industry redefining model are felt even after our products leave the bakery. By shipping products using prebuilt, shippable display cases through our DTW network, we believe we now offer retailers an enhanced merchandising asset and the ability to execute nationwide marketing campaigns with retail-ready displays placed in stores across the country all on the same day. Given the impulse driven nature of the category, in-store displays are a key differentiator in driving sales velocities.

Our new business model is supported by cost-advantaged manufacturing and distribution, expanded channel / retail store reach, enhanced in-store merchandising capabilities, and offers retailers attractive margins that incentivize further distribution of our products.

Experienced team with an entrepreneurial spirit.

We believe our Company culture is an integral part of our strategy, built on entrepreneurship, innovation, collaboration and a competitive spirit. Embodying these tenets is a strong and experienced management team, led by our CEO, Bill Toler, and our Executive Chairman, Dean Metropoulos. Bill Toler has over 30 years of industry experience and previously served as CEO of AdvancePierre Foods. Dean Metropoulos has been involved in many successful transactions involving brands such as Chef Boyardee, Duncan Hines, Ghirardelli Chocolate, Bumble Bee Tuna, Pabst Blue Ribbon, Premier Foods (the biggest UK food company), and Mumm and Perrier Jouet Champagnes. Dean Metropoulos has over 30 years of experience revamping iconic brands throughout the consumer space. In addition, we believe we have a strong supporting cast of senior leaders working in tandem with our management team. Key team members have on average over 19 years of industry experience and expertise across all business functions.

Our Growth Strategy

Our strategy is to be the premium sweet baked goods market leader in the United States by driving industry leading growth that outpaces our SBG peers. This growth will be driven by further strengthening the core business, innovation and line extensions and taking advantage of whitespace opportunities.

Further strengthening the Core Business.

We plan to capitalize on the strength of the Hostess brand, positive market trends, and our attractive retailer economics in order to generate new customers and increase the number of stores carrying our products. Unlike Old Hostess, we now have the ability to unlock the potential afforded by the extended reach of warehouse distribution. Continued distribution and market share gains are expected to come from traditional channels (“core expansion”), with the remainder expected to come from untapped or under-developed whitespace channels (“whitespace opportunity”).

Our master brand strategy, combined with investments in highly effective marketing and brand-building, has resulted in what we believe to be one of the strongest brand equities in snacking.

While we have re-established and grown Hostess’ presence throughout the traditional channels in which Old Hostess previously operated, there remains further opportunity to close the gap in market share relative to Old Hostess’ penetration. By expanding points of distribution, increasing SKU assortments and recapturing shelf space in existing retailers, we plan to continue our sales growth. Our top three products (Donettes®, Twinkies® and Cupcakes) have All Commodity Volume (“ACV”) distribution rates in core channels that are 25% to 50% (based on Nielsen 52 weeks ending February 25, 2017) higher than the average rate achieved by other products in our portfolio. These high levels are directly correlated to the focused approach we implemented on these three products during the relaunch. By applying this tailored and focused approach to our other existing product lines, we will work with retailers to expand the average number of SKUs offered and attempt to materially reduce this gap. The average number of products selling at core retailers today is approximately 22 and we have a number of retailers that have substantially larger shelf sets than the average.

| 2 | Based on internal data, transportation and delivery costs include freight, brokerage, bracket and pickup allowance, distribution centers and stock transport order costs. Net revenue may not be directly comparable due to differences in pricing structure and levels at the Company compared to Old Hostess. |

One area of focus is the previously under-served channel of independent convenience stores and small grocery stores. Similarly, we have an opportunity to continue to build distribution in the drug store and club channels. Importantly, the DTW model enables us to partner with third party distributors (e.g., McLane, Core-Mark) who can profitably penetrate both the convenience and drug store channels and who are looking for opportunities to gain share in the SBG category. Our transition to DTW has created a significant opportunity for distributors to enter the SBG category and partnerships with leading distributors are expected to add materially to our growth going forward.

We believe that impulse purchase decisions are another fundamental driver of retail sales in the SBG category, which makes prominent in-store placement an essential growth lever. The DTW model provides us with a competitive advantage through the ability to utilize retail-ready corrugated displays. These pre-built displays are visually impactful, produced economically, and require minimal in-store labor to assemble or load, thus providing cost-efficient display vehicles that benefit both the retailer and us alike. Preloaded displays also allow us full control over our brand marketing, which allows us to execute retailer-wide campaigns regionally or nationally in a consistent manner, providing a unique competitive advantage across the entire SBG category, which is predominantly DSD-served.

Innovation and Line Extensions.

We understand the need to continually evolve while maintaining the tradition and offerings our loyal consumer base has come to know and love. We have been actively investing in new product development and building our long-term pipeline, leveraging our innovation pipeline and commercialization process to bring new products to market in a timely fashion. Our product innovation strategy is organized around four key objectives:

| • | Complementing our existing product offering by launching classic products not yet launched or entirely new products in SBG sub-segments where we currently do not compete; |

| • | Launching line extensions to drive sub-brand reach; |

| • | Unlocking new consumer segments with new benefits and / or occasions; and |

| • | Expanding into new categories and markets to drive highly incremental growth. |

New product innovation is designed to further leverage our brand equity with consumers, while also further penetrating retailers’ shelves. For example, in 2015 we developed a portfolio of bread products under the Hostess label. The Hostess bread launch was designed for small format channels, (e.g., convenience, drug and dollar) that often cannot get full or consistent service and pricing across their total retail footprint from independent DSD drivers. With extended shelf life (“ESL”) bread via DTW, we can now provide a consistent branded solution to bread service and pricing. In just one year after launch, we have grown our bread share of total combined convenience and drug store channels to 21.5%, making us the number one selling bread brand, behind private label, in these combined channels for the 52 weeks ended February 25, 2017.

We continue to research “better-for-you” concepts, while being true to the indulgent nature of our products. We are exploring opportunities to remove certain negatives (e.g., partially hydrogenated oils, artificial flavors and colors) in our products while increasing the positive nutritional elements. In 2016, we launched Hostess® Mini Muffins with Whole Grain as a differentiator within the category.

Whitespace opportunity.

Our warehouse distribution model has created the potential for us to profitably distribute our products with a significantly further reach than Old Hostess. We are penetrating the grocery channel with our Frozen Retail business, supported by our Deep Fried Twinkies® and licensing arrangements. We will seek to grow our business within food service through a relationship with a national distributor. We have products that are now packaged for sale in Mexico, the United Kingdom and Canada. Our products are also sold on various e-commerce platforms.

In May 2016, we acquired Superior in order to expand our market and product offerings in the In-Store Bakery (ISB) section of the grocery and club retailers. Retailers are increasingly utilizing in-store bakery goods to provide a differentiated shopping experience and to showcase product offerings. Superior manufactures eclairs, madeleines, brownies, and iced cookies, and also offers preservative free and gluten free products. We believe there is also a strong growth potential by expanding Superior’s product offerings within the ISB section of grocery and club retailers.

Platform for future acquisitions.

We believe we serve as a platform for growth within the broader branded snacking universe. Within the highly fragmented SBG category, there exists the opportunity to drive value creation through acquisitions by leveraging our platform, infrastructure and performance driven management culture. Our highly skilled and seasoned leadership is committed to seeking-out opportunities that add new capabilities and product attributes (e.g., Better-for-you) to our already broad offerings. Our experienced management includes several individuals with a proven track-record of successfully managing and acquiring consumer businesses. We believe our scale, access to capital and management experience will allow us to consider both small and large acquisitions in the future and to integrate them in a seamless fashion.

Excerpt from “Prospectus Supplement Summary - Recent Developments”

Preliminary First Quarter 2017 Financial Results

We expect to report for the first quarter of 2017 net revenue in the range of $180.5 million to $184.5 million, compared to pro forma net revenue of $160.2 million for the first quarter of 2016; net income in the range of $22.9 million to $24.9 million, compared to pro forma net income of $12.3 million for the first quarter of 2016; and adjusted EBITDA in the range of $51.5 million to $54.5 million, compared to pro forma adjusted EBITDA of $48.1 million for the first quarter of 2016. The increases are partially attributable to the results of Superior, which we acquired in May 2016, as well as increased sales from distribution and product innovation initiatives and market share gains in our core products. A reconciliation of net income to adjusted EBITDA is set forth below.

Hostess Brands, Inc. Adjusted EBITDA3

Unaudited Reconciliation

| Amounts in millions |

Range of estimates Quarter ended March 31, 2017 |

Pro Forma Quarter ended March 31, 2016 |

||||||

| Net income attributable to Class A shareholders |

$ | 15.2 – 16.5 | $ | 8.0 | ||||

| Net income attributable to noncontrolling interest |

7.7 – 8.4 | 4.3 | ||||||

|

|

|

|

|

|||||

| Net income |

22.9 – 24.9 | 12.3 | ||||||

|

|

|

|

|

|||||

| Plus non-GAAP adjustments: |

||||||||

| Income tax provision |

8.6 – 9.6 | 4.9 | ||||||

| Interest expense, net |

10.0 | 13.2 | ||||||

| Depreciation and amortization |

9.0 | 9.0 | ||||||

| Other expense |

0.5 | 1.3 | ||||||

| Loss on sale/abandonment of property and equipment and bakery shutdown costs |

— | 7.4 | ||||||

| Share based compensation |

0.5 | — | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 51.5 – 54.5 | $ | 48.1 | ||||

|

|

|

|

|

|||||

Note Regarding Preliminary Results We have not yet finalized our financial results for the first quarter of 2017. The preliminary estimated financial results set forth above are subject to revision pending the completion of the accounting and financial reporting processes necessary to complete our financial closing procedures and our financial statements for the first quarter of 2017. The foregoing preliminary estimated financial results have been prepared by management, which believes that they have been prepared on a reasonable basis, and represent, to the best of management’s knowledge, our expected reported results.

| 3 | Adjusted EBITDA is a non-GAAP financial measure commonly used in our industry and should not be construed as an alternative to net income under GAAP as an indicator of operating performance or as an alternative to cash flow provided by operating activities under GAAP as a measure of liquidity. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. We have included adjusted EBITDA because we believe it provides management and investors with additional information to measure our performance and liquidity, estimate our value and evaluate our ability to service debt. |

We define adjusted EBITDA as net income adjusted to exclude (i) interest expense, net, (ii) depreciation and amortization, and (iii) income tax provision and as further adjusted to eliminate the impact of certain items that we do not consider indicative of our ongoing operating performance. These further adjustments are itemized below. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments set forth below. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

Adjusted EBITDA has important limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. For example, adjusted EBITDA:

| • | does not reflect our capital expenditures, future requirements for capital expenditures or contractual commitments; |

| • | does not reflect changes in, or cash requirements for, our working capital needs; |

| • | does not reflect the significant interest expenses, or the cash requirements necessary to service interest or principal payments, on our debt; and |

| • | does not reflect any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future. |

The preliminary estimated financial results were not prepared with the view to complying with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of preliminary estimated results of operations.

Comparisons are to financial results for the first quarter of 2016, presented on a pro forma basis giving effect to the Business Combination as if it had occurred on January 1, 2016. See “Summary Consolidated Financial Information – Supplemental Unaudited Pro Forma Financial Information for the First Quarter of 2016.”

Excerpt from “Prospectus Supplement Summary – Summary Consolidated Financial Information”

Supplemental Unaudited Pro Forma Financial Information for the First Quarter of 2016

The unaudited pro forma statement of operations for the quarter ended March 31, 2016 presents our consolidated results of operations giving pro forma effect as if the Business Combination had occurred as of January 1, 2016. The pro forma adjustments are based on available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma basis, the impact of these transactions on the historical financial information, as applicable.

The Business Combination was accounted for using the acquisition method of accounting. The initial estimated fair values of the acquired assets and assumed liabilities as of the Acquisition Date, which are based on the consideration paid and our estimates and assumptions, are reflected herein. The total purchase price of approximately $2.4 billion to acquire Hostess Holdings has been allocated to the assets acquired and assumed liabilities of Hostess Holdings based upon estimated fair values at the date of acquisition. Third party valuation specialists conducted analyses in order to assist our management in determining the fair values of the acquired assets and liabilities assumed. We have completed our review of the purchase consideration and estimated fair value of assets acquired and liabilities assumed at the date of acquisition. The unaudited pro forma consolidated financial information is included for informational purposes only and does not purport to reflect the results of operations of Hostess Brands, Inc. that would have occurred had the Business Combination occurred as of January 1, 2016.

The unaudited pro forma financial information contains a variety of adjustments, assumptions and estimates, is subject to numerous other uncertainties and the assumptions and adjustments as described in the accompanying notes hereto and should not be relied upon as being indicative of our results of operations had the Business Combination occurred on January 1, 2016. The unaudited pro forma financial information also does not project our results of operations for any future period or date.

The pro forma adjustments give effect to the items identified in the pro forma table below in connection with the Business Combination.

Hostess Brands, Inc.

Unaudited Pro Forma Consolidated Statement of Operations

For the Quarter Ended March 31, 2016

| Historical (i) | Pro Forma | |||||||||||||||

| (in thousands) | Quarter ended March 31, 2016 |

Pro Forma Adjustments |

Quarter ended March 31, 2016 |

|||||||||||||

| Net revenue |

$ | 160,217 | $ | — | $ | 160,217 | ||||||||||

| Cost of goods sold |

89,892 | 258 | ii | 90,150 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

70,325 | (258 | ) | 70,067 | ||||||||||||

| Operating costs and expenses: |

||||||||||||||||

| Advertising and marketing |

7,199 | — | 7,199 | |||||||||||||

| Selling expense |

6,795 | — | 6,795 | |||||||||||||

| General and administrative |

9,638 | (56 | ) | ii | 9,582 | |||||||||||

| Amortization of customer relationships |

156 | 6,033 | iii | 6,189 | ||||||||||||

| Impairment of property and equipment |

7,267 | — | 7,267 | |||||||||||||

| Loss on sale/abandonment of property and equipment and bakery shutdown costs |

180 | — | 180 | |||||||||||||

| Business combination transaction costs |

215 | (215 | ) | iv | — | |||||||||||

| Related party expenses |

1,235 | — | 1,235 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total operating costs and expenses |

$ | 32,685 | $ | 5,762 | $ | 38,447 | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Operating income |

37,640 | (6,020 | ) | 31,620 | ||||||||||||

| Other expense: |

||||||||||||||||

| Interest expense, net |

17,849 | (4,624 | ) | v | 13,225 | |||||||||||

| Other (income) expense |

1,254 | — | 1,254 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total other expense |

$ | 19,103 | $ | (4,624 | ) | $ | 14,479 | |||||||||

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

18,537 | (1,396 | ) | 17,141 | ||||||||||||

| Income taxes |

— | 4,883 | vi | 4,883 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

18,537 | (6,279 | ) | 12,258 | ||||||||||||

| Less: Net income attributable to the noncontrolling interest |

928 | 3,369 | vii | 4,297 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to Class A Shareholders |

$ | 17,609 | $ | (9,648 | ) | $ | 7,961 | |||||||||

|

|

|

|

|

|

|

|||||||||||

| i. | The amounts in these columns represent our Hostess Holdings historical results of operations for the periods reflected. |

| ii. | Represents the adjustment to depreciation expense associated with the allocation of purchase price to property and equipment. |

| iii. | Represents additional amortization expense associated with the fair value recognized for customer relationships in connection with the Business Combination. |

| iv. | This adjustment consists primarily of legal and professional fees and other costs associated with the Business Combination. |

| v. | Represents the reduction in interest expense due to the repayment of Hostess Holdings debt pursuant to the terms of the Business Combination. |

| vi. | Represents the effective income tax rate of 28.5%, giving effect to the noncontrolling interest, a partnership for income tax purposes. |

| vii. | Represents the elimination of historical income attributable to the noncontrolling interest and attributes a portion of the pro forma income to the noncontrolling interest created in the Business Combination. Income is allocated to the noncontrolling interest based on its pro rata share of the total equity of Hostess Holdings. |

Excerpt from “Management”

Executive Officers and Directors

The following table sets forth information regarding our executive officers and directors as of April 7, 2017:

Executive Officers

| Name |

Age | Position | ||

| C. Dean Metropoulos |

70 | Executive Chairman | ||

| William D. Toler |

57 | President, Chief Executive Officer | ||

| Thomas A. Peterson |

44 | Executive Vice President, Chief Financial Officer | ||

| Michael J. Cramer |

64 | Executive Vice President, Chief Administrative Officer | ||

| Andrew W. Jacobs |

49 | Senior Vice President, Chief Customer Officer | ||

| Stuart A. Wilcox |

56 | Senior Vice President, Chief Operating Officer | ||

| Burke E. Raine |

37 | Senior Vice President, Chief Marketing Officer | ||

| Jolyn J. Sebree |

45 | Senior Vice President, General Counsel |

Directors

| Age | Position | |||

| C. Dean Metropoulos |

70 | Executive Chairman | ||

| Laurence Bodner |

53 | Director | ||

| Neil P. DeFeo |

73 | Director | ||

| Andrew Jhawar |

45 | Director | ||

| Jerry D. Kaminski |

60 | Director | ||

| Craig D. Steeneck |

59 | Director | ||

| Mark R. Stone |

53 | Director |

Executive Officers

C. Dean Metropoulos. Mr. Metropoulos has served as the Executive Chairman of the Board since the Business Combination. Mr. Metropoulos is Chairman and Chief Executive Officer of Metropoulos & Co., a boutique acquisition and management firm focusing on the food and consumer sectors. From 2013 until the Business Combination, Mr. Metropoulos served as the Executive Chairman of certain subsidiaries of Hostess and member of the Hostess board. Mr. Metropoulos has over 30 years of experience in acquiring and restructuring businesses in the U.S., Mexico and Europe and has been involved in approximately 80 transactions, including investments in Pabst Brewing Company, Pinnacle Foods Group, Inc. (Swanson/Hungry-Man, Vlasic Pickles, Open Pit Barbeque Sauce, Duncan Hines, Log Cabin Syrup, Mrs. Butterworth’s Syrup, Aunt Jemima Frozen Breakfast, Mrs. Paul’s Seafood, Van De Kamp’s Seafood, Celeste Pizza, & Lender’s Bagels), Aurora Foods, Stella Foods, The Morningstar Group, International Home Foods (Chef Boyardee, Pam Cooking Spray, Gulden’s Mustard & Bumble Bee Tuna), Ghirardelli Chocolates, Mumm and Perrier Jouet Champagnes and Hillsdown Holdings, PLC (Premier International Foods, Burtons Biscuits and Christie Tyler Furniture), among others. Mr. Metropoulos holds a B.S. and an M.B.A. from Babson College. In light of Mr. Metropoulos’ directorship experience, business expertise, financial acumen and business industry contacts, we believe that he is well-qualified to serve as a director of our Board.

William D. Toler. Mr. Toler has served as our President and Chief Executive Officer since the consummation of the Business Transaction and served in the same capacity at Hostess Brands, LLC since April 2014. He brings more than 30 years of consumer packaged goods industry experience to the Company. Prior to joining Hostess Brands, LLC, he worked as an operating partner at Oaktree Capital from October 2013 to April 2014. Prior to that, he served from September 2008 to September 2013 as the Chief Executive Officer of AdvancePierre Foods, Inc., a leading supplier of value-added protein and hand-held convenience products to the food service, school, retail, club, vending and convenience store markets. Prior to joining AdvancePierre, Mr. Toler was President of Pinnacle Foods from July 2005 to September 2008. He has also held key positions at ICG Commerce, Campbell Sales Company, Nabisco, Reckitt & Colman and Procter & Gamble.

Thomas A. Peterson. Mr. Peterson has served as our Executive Vice President, Chief Financial Officer since the consummation of the Business Combination and served in the same roles at Hostess Brands, LLC since March 2016. Prior to that he was employed at Hostess Brands, LLC as the Senior Vice President and Corporate Controller from April 2013 through February 2016. Prior to that, he served as a Managing Director for FTI Consulting from March 2011 to April 2013. Prior to this role, from January 2009 to March 2011, he served as a Director for FTI Consulting.

Michael J. Cramer. Mr. Cramer has served as our Executive Vice President, Chief Administrative Officer since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since April 2013. Mr. Cramer has served as Vice President at CDM Hostess and Vice President at Hostess CDM Co-Invest, LLC since April 2013. In addition, Mr. Cramer has served as the Vice President at Fairmont Aviation LLC since April 2013. From June 2010 through November 2014, he served as Senior Vice President and Director of Pabst Brewing Company. From March 2004 through June 2008, he served as Executive Vice President for Pinnacle Foods.

Andrew W. Jacobs. Mr. Jacobs has served as our Senior Vice President, Chief Customer Officer since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since September 2014. Prior to this role, he was employed at Hostess Brands, LLC as the Senior Vice President, Strategic Channels from February 2014 through September 2014. From September 2012 until February 2014, he served as President of Wolfgang Candy Company. From September 2003 through May 2012, he served as Vice President and General Manager (US Customers) for The Hershey Company. In 2015, Mr. Jacobs and his brother were found jointly and severally liable by the U.S. District Court of Northern Ohio for a civil violation of Exchange Act Rule 14e-3(a) in connection with a stock purchase made by Mr. Jacob’s brother in 2009. Mr. Jacob’s brother was required to disgorge approximately $50,000 in profits related thereto and each were enjoined from future violations of Rule 14e-3.

Stuart A. Wilcox. Mr. Wilcox has served as our Senior Vice President, Chief Operating Officer since the consummation of the Business Combination and served in the same roles at Hostess Brands, LLC since October 2015. From January 2014 through October 2015, he served as Senior Vice President of Operations for Goldenstate Foods. From January 2012 through January 2014, he served as Senior Vice President of Operations for The Original Cakerie. From April 2009 through January 2012, he served as the Vice President of Operations for Chiquita/Fresh Express.

Burke E. Raine. Mr. Raine has served as our Senior Vice President, Chief Marketing Officer since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since March 2016. From February 2014 through March 2016, he served as Vice President, Marketing for Diamond Foods, Inc. Prior to this position, he served as Senior Director of Marketing for Diamond Foods, Inc. from July 2013 through January 2014. From February 2012 through June 2013, he served as Director of Marketing for PEPSICO. Prior to this role, he was employed at PEPSICO as Senior Marketing Manager from February 2009 through February 2012.

Jolyn J. Sebree. Ms. Sebree has served as our Senior Vice President, General Counsel and Secretary since the consummation of the Business Combination and served in the same capacity at Hostess Brands, LLC since April 2013. From March 2012 through April 2013, she served as Senior Vice President, Acting General Counsel and Corporate Secretary at Old Hostess. Prior to this role, she served as Vice President, Assistant General Counsel at Old Hostess from August 2011 to March 2012.

Each of our executive officers serves at the discretion of our board of directors and holds office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal. There are no family relationships among any of our directors or executive officers.

Board of Directors

C. Dean Metropoulos’ biography is set forth under the heading “Executive Officers” above.

Laurence Bodner. Mr. Bodner has served as a director since the consummation of the Business Combination. Since February 2017, Mr. Bodner is the Chief Financial Officer of Soros Brands, a new food and beverage company seeking to acquire brands. Mr. Bodner served as a Senior Advisor at Advent International in its global retail, consumer and leisure team from March 2016 to February 2017. Mr. Bodner served as Executive Vice President, Chief Financial Officer and Treasurer of Big Heart Pet Brands (formerly Del Monte Foods) from 2011 through July 2015. He joined Del Monte Foods in 2003 and served the company for 12 years in increasing levels of responsibility across the Finance and Operations functions. Prior to Del Monte Foods, Mr. Bodner also held senior financial positions at Walt Disney Company as well as The Procter & Gamble Company. Since April 2015, Mr. Bodner has served on the board of directors of Hearthside Foods, a leading bakery, snack and customized solutions contract manufacturer for packaged food products in North America and Europe. Mr. Bodner received his MBA in Finance from Duke University and BA in Economics from Dickinson College. We believe that Mr. Bodner’s extensive experience in the retail and consumer industries will allow him to provide significant insight to our Board and make him well-qualified to serve as a director of our board.

Neil P. DeFeo. Mr. DeFeo has served as a member of our board of directors since the consummation of the Business Combination. Mr. DeFeo is an active corporate advisor and board member. Mr. DeFeo served as a Senior Advisor to CHARLESBANK Capital Partners from 2012 through March 2017. He retired in 2012 as Chairman and in 2011 as CEO of The Sun Products Company, a private $1.5 billion company he helped found in 2008. Prior to that he held Chairman/CEO positions with the NYSE-listed Playtex Products Corporation (2004 - 2007) and The Remington Products Corporation (1997 - 2003). Mr. DeFeo began his career with The Procter and Gamble Company, where he held various positions of increasing responsibility over a 25 year career, leaving as VP/Managing Director Worldwide Strategic Planning—Laundry and Cleaning. Following Procter and Gamble, Mr. DeFeo joined the Clorox Company, with direct responsibility for all of its U.S. business. Mr. DeFeo currently serves on the board of directors of Driscoll’s, a private agriculture company, where he chairs the compensation committee and serves on the company’s nominating and governance committee (since 1998). In addition, Mr. DeFeo serves on the board of directors of The Prostate Cancer Foundation, a not for profit corporation focused on funding research into the prevention and cure of prostate cancer. Over a 40+ year career Mr. DeFeo has served on over 25 boards, both public and private, business and non-profit. He has been involved with over 50 different businesses and brands. Mr. DeFeo holds a bachelor’s degree in Electrical Engineering from Manhattan College, where he also served for 15 years as a director. We believe that Mr. DeFeo’s numerous public and private company directorship roles and his over 40 years of experience in the consumer products industry make him well-qualified to serve as a director of our board.

Andrew Jhawar. Mr. Jhawar has served as a director since the consummation of the Business Combination. Mr. Jhawar previously served as a member of the Hostess Board and a member of the board of directors of Hostess Holdings GP, LLC from April 2013 until the Business Combination. Mr. Jhawar is a Senior Partner and Head of the Consumer & Retail Industry team in the private equity business of Apollo Management, L.P., having joined in February 2000. Mr. Jhawar has sourced, overseen and exited investments for Apollo that have resulted in over $4 billion in profit dollars for Apollo. Prior to joining Apollo, Mr. Jhawar was an investment banker for five years with Donaldson, Lufkin & Jenrette Securities Corporation and, prior to that, Jefferies & Company, where he focused primarily on the structuring, execution and negotiation of high yield debt and equity financing transactions. Mr. Jhawar currently is the Chairman of the Board of Directors of The Fresh Market, Inc. (since April 2016), which is a leading specialty grocery retailer with over 175 stores located predominantly in the Southeastern U.S. and he is also Chairman of the Board of Managers of The Stand, LLC (since August 2015), a growing fast casual Southern California better burger restaurant company. In addition, Mr. Jhawar previously sat on a number of private and public company boards including Sprouts Farmers Market, Inc. (NASDAQ: SFM) from 2011 to 2016, including as Chairman of the Board from 2013 to 2015, Smart & Final, Inc. from 2007 to 2012, General Nutrition Centers, Inc. from 2003 to 2007 and Rent-A-Center, Inc. (NASDAQGS: RCII) from 2001 to 2005. Mr. Jhawar graduated with an M.B.A. from Harvard Business School and graduated, summa cum laude, with a B.S. in Economics from the Wharton School of the University of Pennsylvania. We believe that Mr. Jhawar’s significant experience in private equity and his numerous directorship roles makes him well-qualified to serve as a director of our board.

Jerry D. Kaminski. Mr. Kaminski has served as a member of our board of directors since the consummation of the Business Combination. Since January 2014, Mr. Kaminski has served as Executive Vice President and Chief Operating Officer of the Land O’Lakes, Inc. International business, leading commercial business ventures outside of the United States. The company currently exports products to over 50 countries and has established International as a primary growth platform. Mr. Kaminski oversees Land O’Lakes Global Dairy Ingredients, the Villa Crop Protection joint venture in South Africa, the Bidco Africa joint venture in Kenya and Global Seed Genetics in Mexico. Prior to his current role, Mr. Kaminski was the Executive Vice President and Group Executive of Global Dairy Foods from January 2012 to December 2013, where he led $5B P&L consisting of the entire Land O’Lakes dairy portfolio: Retail Dairy, Foodservice and Global Ingredients. From January 2010 to December 2011, Mr. Kaminski held the position of Executive Vice President and Chief Operating Officer of Industrial Foods, which consisted of the Land O’Lakes domestic dairy ingredients business. Mr. Kaminski was Vice President and General Manager of Dairy Solutions, where he ran Land O’Lakes’ domestic Foodservice business when he joined the company in March 2007 to January 2010. Before joining Land O’Lakes, Mr. Kaminski served as a Vice President and General Manager at General Mills, where he held various leadership positions in the retail and business-to-business segments. Mr. Kaminski also served as President and Chief Operating Officer at Sparboe Foods. In addition, Mr. Kaminski has been on the board of directors of the Global Dairy Platform since 2012, which is an association of the world’s largest dairy companies promoting sustainable dairy consumption. Mr. Kaminski holds a bachelor’s degree in Accounting and Finance from the University of Wisconsin and an MBA in Marketing from the Kellogg Graduate School of Management at Northwestern University. We believe that Mr. Kaminski’s international business experience, together with his background in the consumer packaged goods industry, is of value to our Board and make him well-qualified to serve as a director of our board.

Craig D. Steeneck. Mr. Steeneck has served as a member of our board of directors since the consummation of the Business Combination. Mr. Steeneck has been a member of the board of directors of Freshpet, Inc. since November 2014. Mr. Steeneck has served as the Executive Vice President and Chief Financial Officer of Pinnacle Foods Inc. since July 2007, where he oversees the company’s financial operations, treasury, tax, information technology, investor relations and corporate development. From June 2005 to July 2007, Mr. Steeneck served as Executive Vice President, Supply Chain Finance and IT of Pinnacle Foods, helping to redesign the supply chain to generate savings and improved financial performance. From April 2003 to June 2005, Mr. Steeneck served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Cendant Timeshare Resort Group (now Wyndham Worldwide), playing key roles in wide-scale organization of internal processes and staff management. From March 2001 to April 2003, Mr. Steeneck served as Executive Vice President and Chief Financial Officer of Resorts Condominiums International (now Wyndham Worldwide). From October 1999 to February 2001, he was the Chief Financial Officer of International Home Foods Inc. Mr. Steeneck provides the board of directors with extensive management experience in the consumer packaged goods industry as well as accounting and financial expertise. We believe that Mr. Steeneck’s extensive management experience in the consumer packaged goods industry as well as accounting and financial expertise, make him well-qualified to serve as a director of our board.

Mark R. Stone. Mr. Stone has served as a director since the consummation of the Business Combination. Prior to the Business Combination, he served as our Chief Executive Officer since 2015. Mr. Stone is a Senior Managing Director and President, Operations of The Gores Group, a private equity firm. Mr. Stone is a member of the Investment Committee and a member of the Office of the Chairman of The Gores Group. Mr. Stone has worked at The Gores Group since 2005, in part, focusing on all Gores’ operational due diligence efforts and worldwide operations of all Gores’ portfolio companies. He has been a senior team member with key responsibility in several turnaround value-oriented investment opportunities, including Stock Building Supply (ticker: STCK), a supplier of building materials and construction services to professional home builders and contractors in the U.S; United Road Services, a provider of finished vehicle logistics services; and Sage Automotive Interiors, the largest North American manufacturer of high performance automotive seat fabrics. Mr. Stone has also been involved with the acquisition, successful carve-out and transformation of Lineage Power and VincoTech, manufacturers of telecom conversion products, electronic OEMs, power modules, GPS products and electronic manufacturing services, from Tyco Electronics; Therakos, a global leader in advanced technologies for extracorporeal photopheresis (ECP), from Johnson & Johnson; and Sagem Communications, a Paris-based manufacturer of set-top boxes, residential terminals, printers and other communications equipment, from the Safran Group. He has served as Executive Chairman and/or CEO of several portfolio companies including Siemens Enterprise Communications, a leading Munich-based global corporate telephony (PBX) and unified communications (UC) solutions provider, and Enterasys Networks, a global network solutions provider. Prior to joining The Gores Group in 2005, Mr. Stone spent nearly a decade as a Chief Executive transforming businesses across the services, industrial and technology sectors. Mr. Stone spent five years with The Boston Consulting Group as a member of their high technology and industrial goods practices and served in the firm’s Boston, London, Los Angeles and Seoul offices. Mr. Stone earned a B.S. in Finance with Computer Science and Mathematics concentrations from the University of Maine and an M.B.A. in Finance from The Wharton School of the University of Pennsylvania. We believe that Mr. Stone’s significant investment and financial expertise make him well-qualified to serve as a director of our board.